NZDUSD: RBNZ Rate Meeting Might Send New Zealand Dollar Higher

ATFX Chief Market Strategist Alejandro Zambrano examines the movements in key currency pair NZDUSD in the advent of the Reserve Bank of New Zealand’s forthcoming rate meeting

Written by Alejandro Zambrano, Chief Market Strategist, ATFX

On February 12, the New Zealand central bank, the Reserve Bank of New Zealand (RBNZ), will host a rate meeting. The key interest rate is at 1%, and economists do not anticipate a change in interest. However, their language might change to less dovish as the annual inflation rate increased to 1.9% in the final quarter of 2019, and on February 4, the New Zealand unemployment rate improved to 4% from 4.2%.

As the labor market and inflation are at a good level, there will low pressure for the RBNZ to reduce interest rates at the February rate meeting. Further, the Q4 GDP growth was much higher than projected by the New Zealand central bank, the housing market is strong, and the New Zealand government recently announced a new spending plan of 12 billion NZD over the next four years.

If the RBNZ indeed turns less dovish, then the New Zealand dollar, NZDUSD, might see a boost. The issues for the currency are how the Coronavirus breakout will affect the economy.

Westpac Bank reported that the SARS virus breakout of 2003 only impacted the New Zealand GDP by 0.1%. However, in 2003 only 7% of NZ exports went to China and Hong Kong, today 28% of NZ exports go to China alone, and near 50% goes to Asia excluding Japan.

The most significant impact on the Chinese and New Zealand economies, should not be because of the loss of life. Instead, it will be due to the many million Chinese in lockdown, and currently not working or spending money, as they wait for the virus spread to end.

NZDUSD Technical Outlook

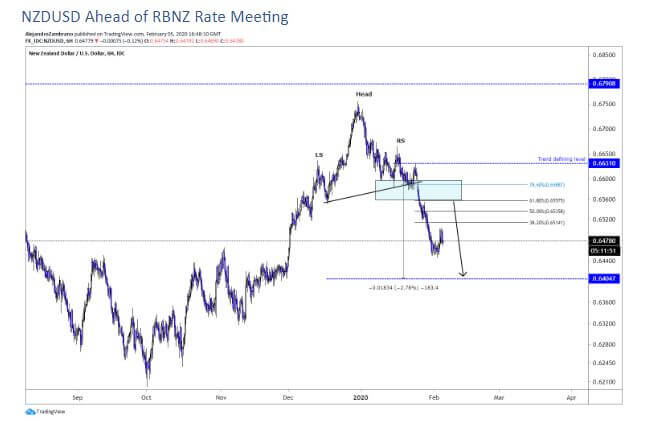

The New Zealand Dollar carved out a significant head and shoulders pattern from December to January. The mover lower was motived by the breakout of the coronavirus.

Also, since then US economic data has improved with both the ISM Manufacturing and ISM Non-manufacturing indices beating expectations. The US APD report on February 5, showed that the US economy created 291,000 new jobs vs. the 156,000 projected. With the US economy improving, and the New Zealand economy probably coming under some pressure because of the coronavirus breakout, I suspect that the NZDUSD will remain under pressure.

The head and shoulders pattern has an unmet target of 0.6404, however, the RBNZ meeting might send the NZDUSD higher, so could news about coronavirus, which has been better in the last few days. However, as long as the price trades below the 0.6631 level, the trend in the NZDUSD will be downwards, and I suspect that traders might try to short-sell the pair in the 0.6550-0.6631 interval.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.