Saxo Bank acquires ordinary shares in BinckBank

Saxo Bank announces that it has conducted transactions in BinckBank shares.

Reference is made to the joint press release by Saxo Bank and BinckBank regarding the announcement of the recommended all-cash public offer for all BinckBank shares (the Shares) dated 17 December 2018 (the Offer).

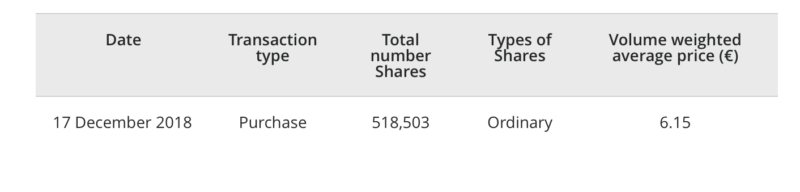

Pursuant to the provisions of Section 5 paragraphs 4 and 5 of the Decree, Saxo Bank announces that today Saxo Bank conducted transactions in ordinary shares of BinckBank or securities that are convertible into, exchangeable for or exercisable for such shares, the details of which are stated below.

The highest price per BinckBank ordinary share paid in a transaction conducted on 17 December 2018 was EUR 6.18 per ordinary BinckBank share.

Following the transactions set out above, Saxo Bank and its affiliates acquired a total of 518,503 ordinary shares in BinckBank, representing 0.77% of the issued share capital of BinckBank and 0.78% of the issued and outstanding share capital of BinckBank.

To the extent permissible under applicable law or regulation, Saxo Bank and its affiliates may from time to time after the date hereof, and other than pursuant to the intended offer, directly or indirectly purchase, or arrange to purchase, ordinary shares in the capital of BinckBank, that are the subject of the Offer. To the extent information about such purchases or arrangements to purchase is made public in the Netherlands, such information will be disclosed by means of a press release to inform shareholders of such information, which will be made available on the website of Saxo Bank. In addition, financial advisors to Saxo Bank may also engage in ordinary course trading activities in securities of BinckBank, which may include purchases or arrangements to purchase such securities.