Saxo Bank raises margin requirements to mitigate geopolitical risk

“We have decided to raise margin requirements on a range of instruments to ensure prudent protection of clients in the event of further escalation of tensions around North Korea’s nuclear programme” – Claus Nielsen, Head of Markets, Saxo Bank

Given the increase in geopolitical tension between North Korea, and the USA, South Korea and Japan, Saxo Bank has decided to raise margin rates on a number of products to protect clients and potentially mitigate market risk stemming from any further escalation in the crisis.

The margin changes are set to go into effect on Wednesday, 16 August 2017, at 08:00 GMT. Saxo Bank will be monitoring the situation closely hoping to revert back to normal margin conditions as quickly as possible.

Head of Markets, Claus Nielsen, commented:

“We have decided to raise margin requirements on a range of instruments to ensure prudent protection of clients in the event of further escalation of tensions around North Korea’s nuclear programme. An escalation of the situation is not our main scenario but looking at the signals and risk, we find it prudent to raise margin requirements to protect clients in the event of larger price moves following a potential escalation of the crisis.

We always take a dynamic approach to leverage levels offered to our clients, adapting margin requirements according to volatility, available liquidity in the market and potential risk events.”

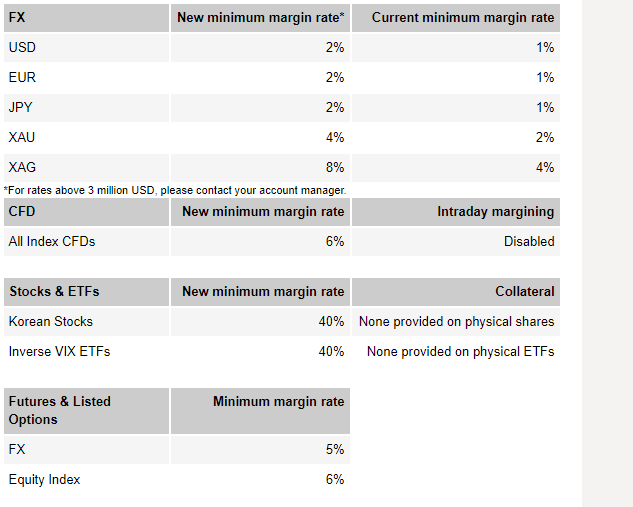

What will the temporary margin rates be?

Kindly check the full overview of upcoming margin changes in all affected markets. The following tables give you an overview of the main markets that will be affected.

How does this impact your trading?

If you have open positions in any of the affected markets, Saxo Bank recommends to ensure that you monitor your positions carefully and maintain sufficient funds in your account to meet the increased margin requirements during this period of turmoil.

Saxo Bank would like to recommend to keep the following in mind, especially when trading during periods of potential market volatility:

- Consider placing relevant resting orders in advance. Market liquidity may vary substantially, and trade/quote requests may be unavailable at times as existing resting orders and new market orders are filled as priority

- Market orders are not guaranteed to be filled at any specific price – they will be filled “at best” according to available market price when processed

- Stop Loss orders are converted to Market orders once triggered, so are not guaranteed to be filled at your stop order level – gaps in available liquidity can result in significant slippage on Stop orders

- Using Stop Limit type orders (rather than Stop Market) can be very beneficial as they allow the client to specify the worst acceptable immediate fill rate after triggering, and they will rest in the order book if not able to be filled immediately

- Buying options (i.e. puts to protect long positions and calls to protect short positions) could be a hedging vehicle suitable for market uncertainty since they offer protection at the fixed Strike price, rather than Stop orders where fills on gapped prices can occur

Saxo Bank hopes to return to normal margin conditions as quickly as possible.