Simply speaking: Why we should worry about wage growth figures more than anything else? – Market editorial by Ramy Abouzaid

ATFX Head of Market Research Ramy Abouzaid looks at the market overview for Friday

By Ramy Abouzaid, Head of Market Research at ATFX

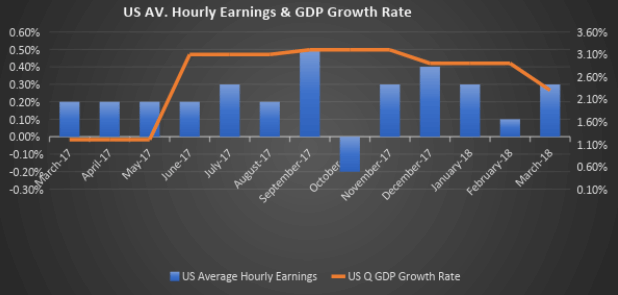

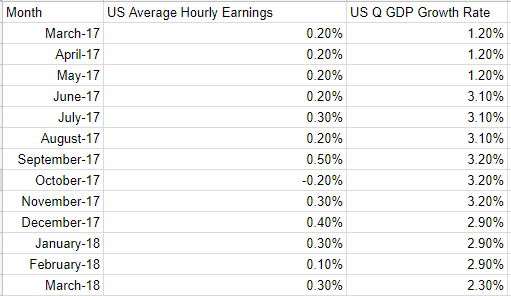

Despite the marked improvement in US jobs figures over recent months, Although the encouraging figures for jobless claims figures of last week, however, the change in the average wage growth in the United States remains the pivotal event that markets are still watching closely, even after the markets are getting used to watch a good numbers, from payrolls figures and the lowest unemployment rates in decades, yes the headlines are very good but this improvement has not yet reached significantly to wages.

In all modern economies today, consumers spending is the biggest driver of economic growth, for the economy to maintain stable growth rates, the growth of these economies must stimulate by the daily expenses of individuals. This spending is reflected in the profitability of the companies which is looking to expand with the business boom and try to enhance their presence in the market, which of course requires a larger number of employees who will be paid salaries and then can spend this money on their daily lives and so on.

All of that going in the interest of increasing demand for goods and services, which drives their prices to rise, which means high inflation rates, so when the central banks start to hike interest rates in the light of moderate rise in inflation means that rebalancing the economy, which mean the economic growth will became more stable and more solid.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.