“Sound as pound” is no longer actual – Guest Editorial

A detailed insight into the currency markets from an FX trading perspective from the management team at EagleFX

The management team at EagleFX give a detailed perspective from their point of view on the effect on the currency markets created by the current political movements in the UK

Brexit’s Peril, Trading a Falling Pound

Long considered one of the most stable and liquid currencies in the world; 3 years ago ‘sound as a pound’ optimism radically changed. Brexit uncertainty and nervousness turned out to be a headache for forex traders.

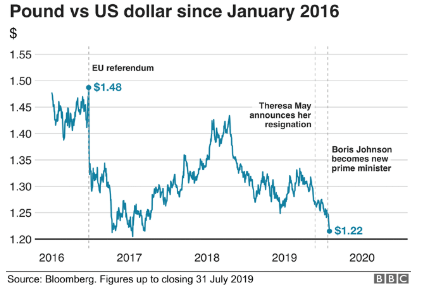

Sterling was trading at just below $1.50 before Britain voted to leave the EU in June 2016.

From the Bloomberg BBC magazine graph below, it’s clearly visible that the value of the pound sterling has dropped significantly since the EU referendum.

Within just 24 hours of vote results the rate fell from $1.5 to $1.32. As sterling’s strength continued to decrease, GBP-holders panic sold to save their personal financial viability.

Do we have to panic now again, is there a trading opportunity for forex traders on reputable brokers such as EagleFX.com if a ‘no-deal Brexit’ now happens?

It is important to remember that currencies are traded in pairs. Therefore, if you want to buy GBP / USD, it is because you think that the British pound will strengthen against the US dollar.

Conversely, if you open a sell deal, GBP/SGD, you think the British pound will weaken against the Singapore dollar. Think of it as a swing – when one rises, the other falls. Access to multiple markets for trading can be beneficial for global traders. One reason for this is that you can analyze the counter currency (the second currency in the pairing) to identify the weakest.

Thus, you combine a strong currency with a weak currency, which usually leads to a stronger direction of movement. In this case, it’s essential to be aware of possible trading opportunities and which strategy you choose. For example, EagleFX.com experts say: “The GBP/USD continued to trade in a bullish channel, but is in a bearish mood as it has slipped to lower corner of the channel. The 1.2160 level is an area of ground, and now it seems as if we will continue to see a lot of noise in this region.”

The market sees a deal between the UK and the EU as bullish for the British pound. The no-trade deal scenario seems to be bearish for the British pound. Therefore, traders can begin to make a list of instruments for trading in the event that the British pound rises or falls in response to the news. A quick way to determine if a currency pair is strengthening or weakening is to use moving averages.

If you are trading all alone and unable to analyze such graphs, it can be quite useful to trade on a broker’s platform such as EagleFX, because there you can receive guidance with regular reviews about trading opportunities.

Trading expert Cory Mitchell points out the importance of selecting hours while trading, “Just because the forex market is open 24-hours a day, doesn’t mean every one of those hours is worth trading. The GBP/USD, with a cross rate of 1.30 on August 3, 2018, has certain hours which make more sense for day trading because there is enough volatility to generate profits over and above the cost of the spread and/or commission.

To be efficient and capture the largest moves of the day, day traders hone in even further, only trading during specific hours of the day.” It means that trading with appropriate timing can maximize your profit potential.

Deal or No Deal?

Firstly, there are 2 possible scenarios of Brexit, the so-called “deal” and “no-deal” Brexit. A “deal” implies that, from an economic point of view, the “rules of the game” will stay unchanged. The UK and the EU will stay members of the “customs union”. Import duties in goods will not be imposed and full mutual access to capital will still be maintained.

However, the EU insists on preserving all the rights of EU citizens in the United Kingdom and on a significant limitation of Britain’s ability to regulate immigration (which, in many respects, contradicts the main idea of Brexit). Parliament has repeatedly failed to vote on the adoption of the terms of the European Union. Each failure resulting in another slash in Sterling.

Theoretically, if before the “deadline” (at the moment – October 31st) the “deal” does not take place, then Brexit will go through the “tough” scenario. Full-fledged customs and full-fledged border control will appear between the EU and Britain, and all agreements on the movement of capital and goods will be broken – the UK will cease to be the financial centre of Europe.

Both parties are already working on solution packages for the “tough” scenario, but at the same time the deadline has been repeatedly postponed, everyone hopes that an agreement will nevertheless be concluded. Economists say that in the short-run it can lead to negative economic growth, but in the long-run, the decline can be reversed if accompanied by lower interest rates.

An expert Kevin Matthews says, “While in Manchester, Johnson promised to allocate over three and a half billion pounds for the development of profitable areas in the United Kingdom. He states that he is still declaring his desire to join the EU.

If this happens, it will lead Britain to a recession. At the same time, the treasury will lose 30 billion pounds in a year. It is minus 37 billion in terms of dollars.” Meanwhile, a new report by the Confederation of British Industry says that the EU is as bad at Brexit without a deal as the United Kingdom. So if the second no-deal scenario happens, it may affect the sterling rate significantly, so traders have to keep an eye on regular news concerning Brexit, and be prepared to act immediately.

What do British politicians think?

Politicians impose a quite different opinion on this topic. As the former chancellor, Philip Hammond, claimed a Corbyn government would cause, “A crash in the value of the pound, causing a shockwave of inflation.” Jeremy Corbyn said after one of the meetings he would put forward a proposal which will make sure that parliament is able to debate a legislative way of preventing the government crashing us out with no deal … the legislation will be laid by people from all of the opposition parties and will be supported by some Conservative MPs as well.

From eaglefx.com broker’s (where you can trade on MetaTrader 4 platform) short report, it’s visible that GBP positions are getting better, because of dollar fluctuations.

“On Tuesday, the GBP/USD pair reached a fresh August high of 1.2309, keeping up with the gains by the end of the day, as speculative interest dropped the dollar on concerns of a US recession, while Sterling gained support in headlines signalling that opposition MPs accepted on a strategy to block a no-deal Brexit.” So if labourists support the idea of hindering no-deal Brexit, it shows a quite good tendency of a pound reinforcement.

Secondly, if being more optimistic, modern experts argue that it’s quite unreasonable to consider that the British economy will not improve with time, because Great Britain used to invest a lot of money in EU projects and with Brexit Britain currently is free from many payments to the EU budget.

Now after the procedure of separation, they can use this capital to support their own industries. Also, these funds will be accumulated in the country’s budget and allocated to the development of economic relations.

But what about the dollar?

Everyone is concerned with falling pound but don’t forget that forecasts about the U.S. recession are gaining noise. For Christopher J. Wolfe, a chief investment officer of First Republic Private Wealth Management, “the interest-rate differential with other countries is the key to why the dollar is remaining strong.”

He added: “The U.S. dollar is the easy and clear choice as a deposit safe haven.” It’s quite controversial that dollar has even stronger positions now because the U.S. economy really begins to decelerate and the dollar continues to strengthen, that could mean some warning signs and that’s why the U.S. along with international counterparts tend to make an effort together to weaken the dollar.

What does it mean for us traders? An expert, Yohay Elam demonstrates three currencies to buy: Japanese yen, US Dollar or Swiss Franc. It means that portfolio diversification is also very useful while trading in forex.

Consequently, it is getting obvious that Brexit is inevitable and the most optimal thing a trader can do is to create plan A and B in case of “deal” and “no-deal” Brexit while trading with a suitable execution mode.

For example, as on Eaglefx you can choose from three trade execution modes, including instant Execution, as well as market execution, pending, stop orders and a trailing stop function not only with forex.

In the case of “no-deal” Brexit scenario, it would be bearish for the pound. If the scenario continues to happen temporarily, the pound would decline, but in a long-run incline is possible along with economic growth. In the unlikely scenario where there is no deal altogether and no proposed deal insight, this would be especially bearish.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.