Spotware cTrader Web 3.0 Introduces All-in-One Experience

The new version introduces an all-in-one trading experience by bringing together everything needed for successful trading.

Spotware, an award-winning trading solutions provider, has announced its update of cTrader Web Beta to version 3.0. The new version introduces an all-in-one trading experience by bringing together everything needed for successful trading.

Commenting on the launch, Panagiotis Charalampous, Head of Community Management at Spotware, stated: “Our goal was to equip traders with useful information and tools, while providing them with more usability, simplicity and flexibility. Now, traders can take much more weighted decisions, as well as quickly grasp the current market situation, and act right away when opportunity strikes.”

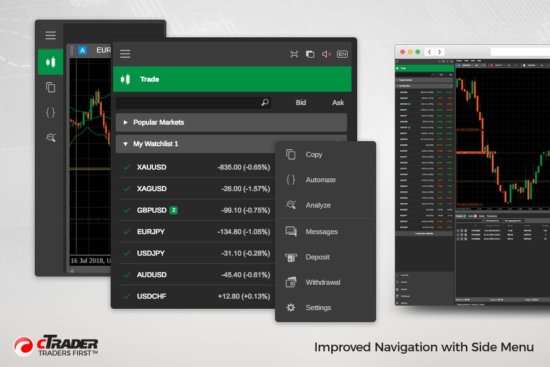

- Improved Navigation with Side Menu

The newly redesigned cTrader Web 3.0 Beta has introduced the foldable side menu that collects all controls, navigation, and applications in one place. From here, traders can take fast actions, modify all settings and preferences, trade and analyze their performance just in a click. The side menu has also embedded a symbol finder and watchlists under the trade application. This new look and feel makes the use of the platform much simpler and more convenient.

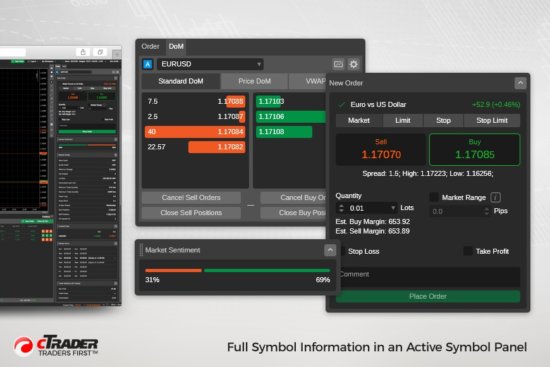

- Full Information per Symbol

Traders can now see full market overview per symbol at a glance thanks to the Active Symbol Panel. This is a new element that contains Market Sentiment, Market Details, Trade Statistics, Market Hours, related Links, Inverted Rate, Leverage, as well as Depth of Market. In addition, traders can take fast actions right from the Active Symbol Panel, including opening of new charts, creation of new orders and change of symbols. What’s more, the Active Symbol Panel is configurable, and can be enabled to switch symbol from it in Watchlists and Tradewatch at the same time. The extended information per symbol and fast action tools equip traders with greater trading possibilities.

- Trading Performance Analytics

The new version has also incorporated a new analytical tool which allows traders to quickly understand the current state of trading activities as well as analyze performance from different perspectives and time ranges. The Analyze application contains key trading performance info, such as Performance Summary, Equity chart, Performance chart, Statistics on Performance, Volume, and Trading.

- New Features

Based on the traders’ demand, new features like linked charts and open positions counter have been added to the platform’s functionality. It also shows now Trade Value and has possibility to manage sessions on different platforms and devices for more security. In addition, cTrader has introduced new application layouts and languages: Slovak, Malaysian and Indonesian.

Overall, the new update greatly benefits traders on all aspects, while making cTrader a truly first in class trading platform that puts the needs of traders first and allows to expand their possibilities even further.

To view and try the new cTrader Web 3.0 Beta version, please visit https://ct.spotware.com.