Spotware Systems adds Stop Limit Order to cTrader platform

The combination of a Stop Order and a Limit Order offers the investor much greater precision in executing a trade.

Spotware Systems, a neutral financial technology provider offering comprehensive eFX STP solutions for brokers, banks and their clients, announces that it has added a new order type to their cTrader platform.

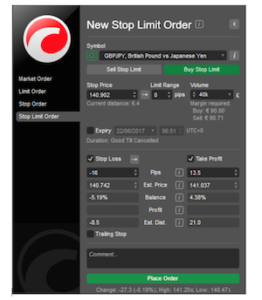

The new order type is a Stop Limit Order, and it has been added to desktop, web, iOS and Android versions of the platform, and it is available to all users of all brokers offering the platform.

The new order type is a Stop Limit Order, and it has been added to desktop, web, iOS and Android versions of the platform, and it is available to all users of all brokers offering the platform.

A Stop Limit Order is a combination of a Stop Order and a Limit Order. The combination of the two orders offers to the investor much greater precision in executing the trade. Contrary to a Stop Order that is filled at the market price after the stop price has been hit, regardless of whether the price changes unfavorably. A Stop Limit Order places an order that sets a limit to the price that the investor accepts for the order. While a Stop Order can lead to trades being filled at less than desirable prices, combining it with the features of a Limit Order, trading is halted once the price becomes unfavorable, based on the investor’s Limit Range.

In summary, traders can benefit from the limit of price deviation which is associated with Limit Orders while being able to Buy above the market and Sell below the market as with a Stop Order.

Panagiotis Charalampous, Business Development Manager at Spotware, said:

“At Spotware, we put traders needs first. Stop Limit Order has been one of the most wanted additions to cTrader by the community and Spotware has satisfied a desire of thousands of traders. With this release, we deliver another powerful tool in the hands of traders. Now traders will be able to perform even more precise trading and expand the diversity of their trading strategies”.