Swissquote launches virtual currency trading

Swissquote is the first online bank in Europe to offer Bitcoin investing.

Swissquote, the leading online bank in Switzerland, today launched Bitcoin trading on its trading platform. Simple, safe Bitcoin trading is now available to all customers with a Swissquote trading account.

Bitcoin is a virtual currency, completely independent of any institutions, including the monetary policies of the central banks and their key interest rates. Bitcoin’s price is set freely, according to supply and demand.

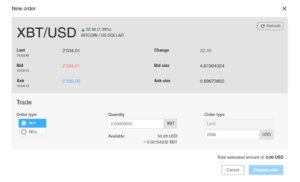

Swissquote customers can exchange Euros or US dollars for Bitcoins on the Swissquote platform. Customers may speculate on Bitcoin or use it diversify their portfolios.

Customers invest in Bitcoins against the Euro or the US Dollar through their trading accounts, just as they would with any other currency, except without access to leverage. Because there is no leverage, there is no risk of losing more than the invested amount. The minimum Bitcoin transaction is set at five USD/EUR and the maximum is set at 100,000 USD/EUR. Fees are set as a percentage of the transaction amount. They range from 0.5% to 1%, depending on the total invested.

Customers invest in Bitcoins against the Euro or the US Dollar through their trading accounts, just as they would with any other currency, except without access to leverage. Because there is no leverage, there is no risk of losing more than the invested amount. The minimum Bitcoin transaction is set at five USD/EUR and the maximum is set at 100,000 USD/EUR. Fees are set as a percentage of the transaction amount. They range from 0.5% to 1%, depending on the total invested.

For this project, Swissquote partnered with Luxembourg-based Bitstamp, a company specialized in Bitcoin trading since 2011, Bitstamp is the first and only Bitcoin exchange to obtain a license from the European Union, and it is a leading expert in virtual currencies. Bitstamp provides pricing data and executes Bitcoin transactions for Swissquote customers. The Swissquote-Bitstamp partnership marks a milestone in the already promising development of Bitcoin, which is being integrated gradually into the traditional financial system.

Marc Burki, CEO of Swissquote, said:

“Many investors are interested in cryptocurrencies but are afraid to trade them because the players in this market are mostly little known, and they often require the transfer of funds to a foreign account. As a Swiss Bank, we offer our clients a simplified, transparent process, without foreign transfers, that is within reach of everybody”.