Trade execution transparency gains pace as Autochartist acquires controlling stake in VerifyMyTrade

Headed up by Jeremy White, VerifyMyTrade’s ethos is to combine regulatory technology solutions and provide them as a marketing and sales tool for brokers, with the aim of turning an overhead into return on investment

Autochartist is proud to announce that it has concluded acquisition of a controlling stake in VerifyMyTrade, a company specializing in measuring the quality of execution in the retail forex market.

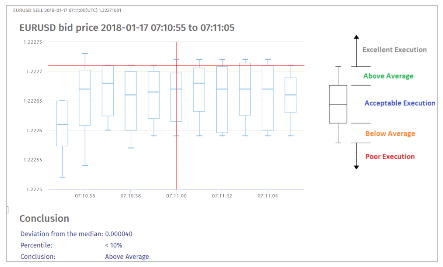

The VerifyMyTrade Trust Builder enables traders to verify, via an industry acknowledged impartial service provider, whether the price they receive on a trade is market related. VerifyMyTrade enables brokers to address price dispute resolution processes internally, and provides a monthly regulatory report on the brokers quality of price execution for regulators or for marketing purposes.

“VerifyMyTrades fits perfectly with the Autochartist content for broker marketing, sales, retention and VIP solutions.” says Autochartist CEO Ilan Azbel, “Transparent demonstration of quality price execution enables brokers to achieve the dual objectives of building trust with traders and meeting regulatory requirements.”

Since its launch in December 2017, VerifyMyTrade has concluded several agreements with brokers that use its services for analysis of price competitiveness and internal regulatory and dispute resolution processes. It has also formed a partnership with the Financial Commission, which now uses VerifyMyTrade within its price dispute resolution processes.

VerifyMyTrade is headed up by Jeremy White, a seasoned financial markets professional. Mr White says “The combination of regulatory technology solutions as a marketing and sales tool for brokers enables brokers to get significant return on investment in what is traditionally considered a cost or overhead to their business.”

“Partnering with the Autochartist group enables us to rapidly expand our sales reach within the forex industry at a time when price competitiveness and quality of execution is front-of-mind with respect to MIFID II.” says Mr White