US – Iran tension, are we going to war or is it just skirmishes? How will the markets decode the scene?

ATFX (AE) market specialist Ramy Abouzaid looks at the potential effect on the commodities and global trading markets during these times of tension between the US and Iran

Information provided by: Ramy Abouzaid, ATFX (AE) Head of Market Research

In the early hours of Wednesday the 8th of January 2020, the Pentagon confirmed the attacks targeting two American bases on Iraqi soil with fifteen ballistic missiles launched from Iranian territory.

According to US military sources, via ABC news networks, ten of these missiles targeted Ain Al-Assad base in Western Iraq – the largest US military base in the country, one missile targeted Erbil base on the Northern side, and four missiles failed to reach their targets. While Iraqi sources reported a number of 22 missiles launched from the Iranian soils, with no causalities reported.

The Iranian attack comes in response to the killing of the Quds Force Commander of the Iranian Revolutionary Guards, in an American drawn strike at dawn last Friday. Following the missile strikes, several Iranian statements warned the US from taking any response, which would lead to an All-out war in the region.

The US reports denied any losses in the ranks of the American forces, but hasn’t denied equipment losses. As from Tehran’s side, the reports claimed that the strike had hit the specified targets claiming the lives of 80 US soldiers.

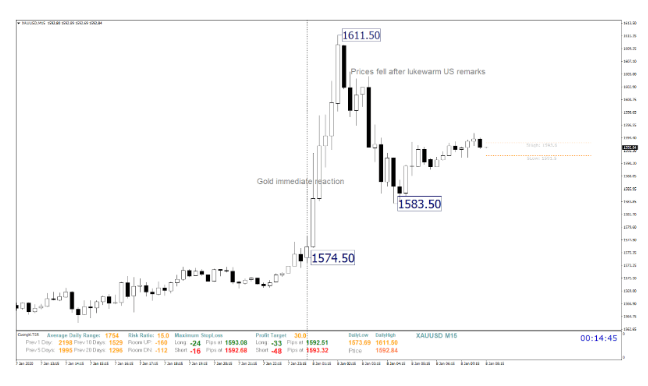

The markets have responded rapidly, the gold recorded an increase of around 37$ per ounce as an immediate response to the dangerous development of events, as it rose from the levels of 1574 to 1611.50, an increase of about 2.3%.

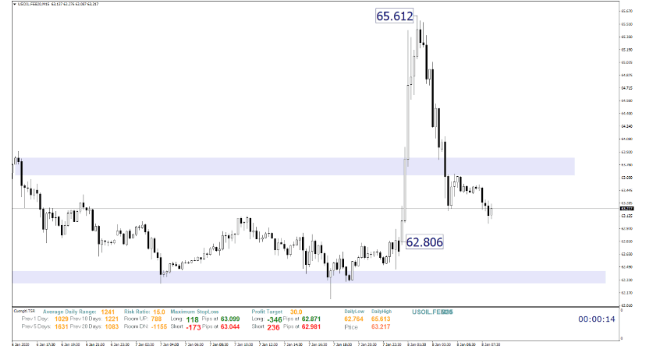

As for oil, the US light crude prices rose to the levels of 65.61$, a direct translation to the markets fear of supply shortages due to the escalating events in the Middle East; a vital zone to energy markets.

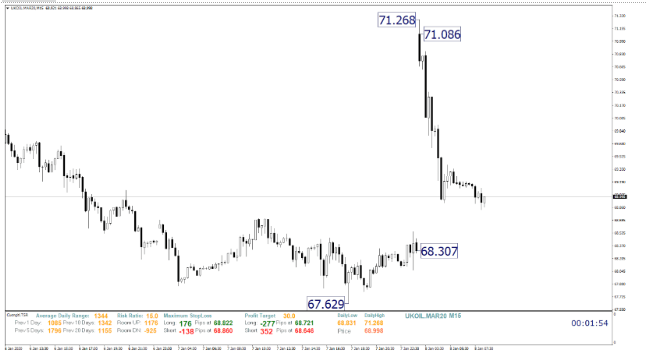

While Brent crude recorded increases to the levels of 71.26 $, it is noticeable that oil prices rebalanced those quick gains after the lukewarm US statements. This reduction can be explained as well following the statements of the Minister of Energy in the United Arab Emirates, in which he assured that an urgent meeting of OPEC and its partners is not needed, and that OPEC is ready to deal with any new developments to maintain oil supplies and price stability.

Until now, the markets are analyzing the scene as mere skirmishes between the two parties, and that the missile strike is just a limited reaction from the Iranian side to “avenge” the death of their influential military man. Until this moment, this interpretation is reinforced by the calm American reaction. Even the US President did not set up an urgent press conference to comment on the event.

This might indicate that the American administration prefer to manage the situation calmly, contrary to what was expected from the US President, especially according to his previous tweets which avowed that the United States will respond strongly and rapidly to any reaction from the Iranian side on American Targets. A promise that was not fulfilled, at least not up until now.

Legal: ATFX is a trading name of AT Global Markets Limited (ATGM, registration number 24226 IBC 2017). ATGM is an International Business Company in Saint Vincent and the Grenadines. Registered address is : The Financial Services Centre, Stoney Ground, Kingstown, St.Vincent & the Grenadines.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.