Vantage FX: Brexit Referendum – Margin Requirements Returning to Normal

Vantage FX will now begin easing restrictions across a range of Forex currency pairs and Indices markets post-Brexit referendum.

Sydney – June 30, 2016. After deciding to increase margin requirements heading into the Brexit vote, Vantage FX will now begin easing restrictions across a range of Forex currency pairs and Indices markets.

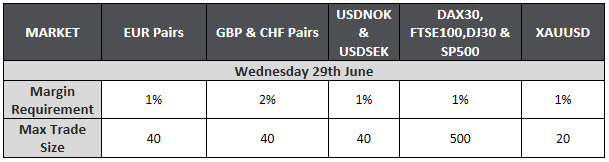

Please refer to the table below for our latest margin requirements as of June 30th, 2016:

As a reminder, client funds are held in segregated funds held by National Australia Bank (NAB) separate from Vantage FX company funds as required by ASIC regulations. If you have any queries, feel free to contact your Account Manager or our Support Team at [email protected].

We are here to assist you 24 hours a day, 5 days a week, if you have any questions or require assistance with the above please do not hesitate to contact us using the details listed below.

For more information

Contact: David Bily

Phone: +61 1300 945 517

Email: [email protected]

About Vantage FX:

Vantage FX are a multi-award winning Australian Forex Broker providing innovative online Forex trading capabilities to clients globally. Vantage FX continually strives to provide a client-friendly, interactive Forex experience with trading accessibility across a variety of platforms all with the tightest spreads. Vantage FX was the first to offer combined Binary Options and Forex Trading on the one MT4 platform. Vantage FX is an authorised representative of Vantage Global Prime Pty Ltd (AFSL 428901) and regulated by Australian Securities and Investments Commission (ASIC).