Weekly Preview: 5 Currencies to Keep an Eye on for the Week Ahead (Dec 16 – Dec 20)

The Japanese Yen was the biggest loser this week, as encouraging news related to the US-China trade war spurred risk-appetite. Wall Street rallied to record highs after good news from the trade front, say senior management at AxiTrader

In this Guest Editorial, the management team at AxiTrader look at analytical aspects of importance in retail trading, with a focus on five major currency pairs.

- USD: Flash Manufacturing PMI and Final Q3 GDP in focus, USD could bounce as trade optimism persists

- GBP: Markit Manufacturing and Services PMI, Employment, CPI, PPI, GDP and Retail Sales data in focus, BOE’s interest rate decision ahead as well.

- JPY: JPY drops as trade optimism comes back after Phase One Deal is signed

- EUR: Eurozone’s CPI, Consumer Confidence, Manufacturing and Services PMI, Germany’s PPI, IFO Business Climate and GFK Consumer Confidence Survey numbers in focus

- AUD: AUD could strengthen, backed up by trade optimism

CURRENCY: USD

USD edged lower this week as Fed has announced no change in its policy stance. In the Fed statement, the removal of ‘uncertainties’ in the outlook further reinforced the idea that the bar to cut rates has been set higher.

Washington and Beijing agreed to a first phase of a broader trade deal on Friday that will see China boost imports, including of American agricultural products, and the U.S. halving duties on $120 billion of Chinese goods. This brings back green shoots of economic recovery to the market and could strengthen up USD. On the data front, this week we will have important data releases including Flash Manufacturing PMI and Final Q3 GDP.

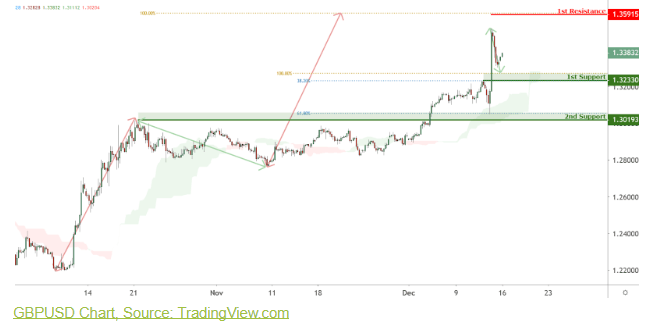

CURRENCY: GBP

Sterling extended its rally on optimism that a speedy resolution to the Brexit deadlock is in store after the Conservative Party’s election victory. The currency edged higher as Chief Secretary to the Treasury Rishi Sunak said that the government plans to put its Brexit legislation before Parliament before Christmas to ensure that the country will leave the EU as planned at the end of January.

Looking ahead, on the data front, investors will be keeping a close watch on the Markit Manufacturing and Services PMI data, employment numbers as well as the CPI, PPI, Retail Sales and GDP data which could put a damp on the recent optimism should the numbers missed estimates. This week will also see BOE’s interest rate decision as well. That said, any impact from the data is likely to be short-lived as the focus remains on Brexit’s developments.

CURRENCY: JPY

The Japanese Yen was the biggest loser this week, as encouraging news related to the US-China trade war spurred risk-appetite. Wall Street rallied to record highs after good news from the trade front.

Washington and Beijing agreed to a first phase of a broader trade deal on Friday that will see China boost imports, including of American agricultural products, and the U.S. halving duties on $120 billion of Chinese goods.

The U.S. has also delayed levies that were due to be imposed on Sunday, and China said it will suspend additional tariffs on certain American imports. This week we will have the BoJ meeting due, where no change is expected. The market is waiting for more progress and details after Beijing and Washington signed the Phase 1 Deal, as the optimism continues, JPY could continue the drop.

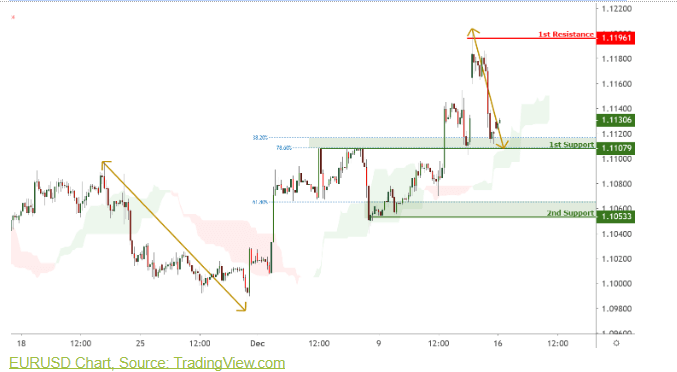

CURRENCY: EUR

EUR rallied against the greenback last week on a broad dollar weakness, while riding on the EUR strength as the ECB increased its CPI forecast and was more optimistic about the slowdown in the Eurozone bottoming out.

Looking ahead, on the data front, investors will be keeping a close watch on the Eurozone’s CPI, Consumer Confidence, Manufacturing and Services PMI data as well as Germany’s PPI, IFO Business Climate and GFK Consumer Confidence Survey numbers where anticipation for these data could fuel the currency’s rally. Besides, now that the US-China phase one trade deal agreement is reached, the improved market risk sentiment could prop the EUR higher.

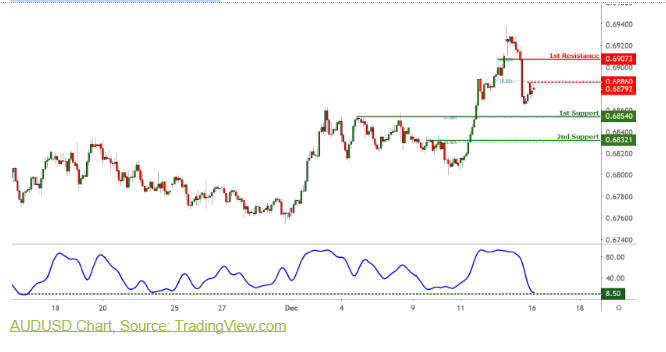

CURRENCY: AUD

AUD carried it’s upwards momentum over from the previous week into last week. The upwards push of the AUD was helped when the US Fed announced a dovish policy decision, leaving interest rates unchanged.

Further, the AUD also climbed greatly as US president Trump signed off on a so-called phase one trade deal with China coupled with UK Prime Minister Boris Johnson showing a decisive win in the UK election. This week, we would have key economic data release coming up for both the AUD such as ANZ business confidence, Employment change. AUD could strengthen up as optimism over China’s growth is picking up.

Find out more at AxiTrader here.

The information is not to be construed as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product, or instrument; or to participate in any trading strategy. Readers should seek their own advice. Reproduction or redistribution of this information is not permitted.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.