Weekly Preview: 5 Currencies to Keep an Eye on for the Week Ahead (Dec 30 – Jan 3)

Senior analysts at AxiTrader start the week by noting that the Pound edged lower as investors remain wary of increasing risks of a hard Brexit with Boris Johnson signaling a hard Brexit deadline by end December 2020.

In this Guest Editorial, the management team at AxiTrader look at analytical aspects of importance in retail trading, with a focus on five major currency pairs.

- USD: USD drifted down due to downbeat data, Pending Home Sales and ISM Manufacturing PMI data in focus this week

- GBP: Focus remains on Brexit’s developments

- JPY: BoJ keeps it policy unchanged while slightly hinted more stimulus is possible

- EUR: Germany’s retail sales, Manufacturing PMI, Unemployment and CPI data in focus

- AUD: AUD strengthening on strong job report and low volatility expected

CURRENCY: USD

Last week, the Dollar weakened against most of the major currencies following its disappointing data and improved market risk appetite, as the focus remains on the signing of the Phase 1 deal in January.

On the data front, US Durable Goods Orders, Nondefense Capital Goods Orders excluding Aircraft and New Home Sales fell short of estimates, causing the USD to edge lower. Looking ahead, it is a light calendar week for the USD and investors will be keeping a close watch on the Pending Home Sales and ISM Manufacturing PMI data where missing estimates could see the dollar extends its decline.

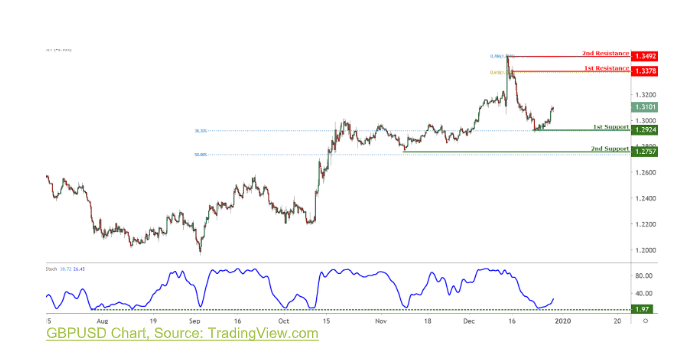

CURRENCY: GBP

The Pound edged lower as investors remain wary of increasing risks of a hard Brexit with Boris Johnson signaling a hard Brexit deadline by end December 2020. Looking ahead, it is a light calendar week ahead for the Sterling as focus remains on the Brexit saga. On the data front, investors will be keeping a close watch on the Markit Construction and Consumer Credit data though any impact would be minimal as the Brexit’s developments remain in limelight.

CURRENCY: JPY

The JPY traded generally sideways last week. This is probably due to BOJ’s Governor Kuroda neutral stance coming out from his speech that the BOJ “considers that downside risks regarding global trade sentiment and macroeconomic policy continues to remain significant” and yet at the same time he encouraged that the “Olympics boom back in 1964” could help bolster Japan’s economy in the new year ahead and that there is “no need to be too pessimistic”. Given the improving risk-on climate ever since the signing of the Phase 1 deal, there could be a possibility investors see the JPY dropping.

CURRENCY: EUR

EUR edged higher as it piggybacked on the recent trade optimism along with a broad dollar weakness. Looking ahead, on the data front, investors will be keeping a close watch on Germany’s retail sales, Manufacturing PMI, Unemployment and CPI data where anticipation for the data could drive prices higher.

CURRENCY: AUD

AUD strengthened further last week, maintaining its rally for the 2nd week running. While it was a light economic week for the AUD, the sustained rally is possibly helped by the fact that USD weakened due to it’s disappointing data and improving risk sentiments globally from last week.

Further, with Chinese industrial profits posting improvements at the end of November, this helped provide upwards momentum for AUD though the move was muted mid-week due to the Christmas break. Moving forward, given a huge improvement in global trade sentiments, investors can expect the AUD to strengthen further. Investors should continue to keep their eyes peeled on any new development on global trade policies. An adverse news could otherwise send the AUD plummeting.

Find out more at AxiTrader here.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.