Will the US Job figures Shock the Markets? – Guest Editorial

ATFX AE Head of Market Research Ramy Abouzaid looks at the stock chart patterns driven by the US job market figures

By Ramy Abouzaid, ATFX (AE) Head of Market Research.

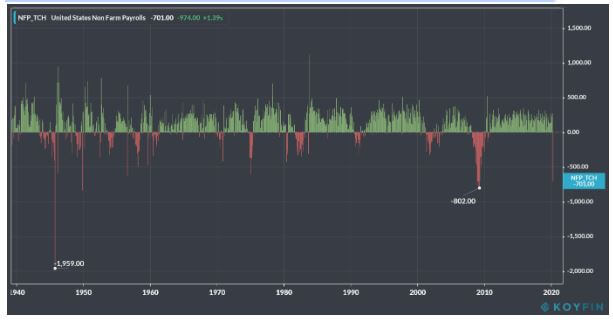

The American economy had recorded a sharp, yet expected, loss in job numbers in March report, as the report witnessed a loss of about 701,000 jobs in March, a figure that we expect to be revised in April’s report showing worst figures than the forecast. The reading in March was much worse than the average market expectation for the US labour market with a loss of around 100,000 jobs.

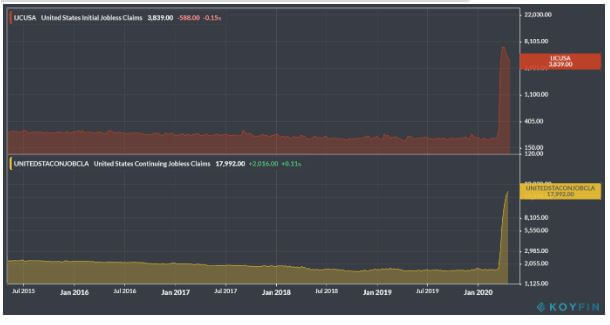

It should be noted that the loss reported in the monthly jobs report is the deepest since September 2010, but the numbers have not yet reached the losses recorded during the Great depression nor during the financial crisis of 2008, and as is known, the March’s report figures excluded last two weeks of March in which claims for unemployment benefits reached 10 million. Although, If we take a look at the five weeks between the data of March and April reports, we will find that the initial requests for unemployment benefits have increased by more than 26 million.

.

.

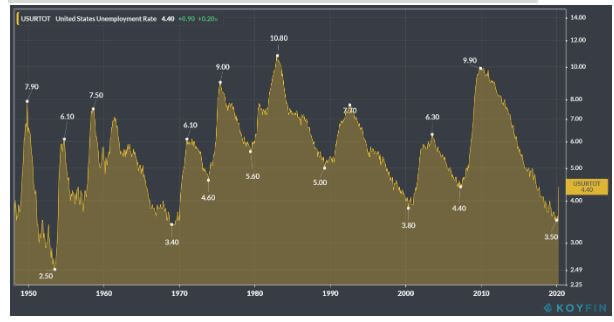

Based on all announced figures until the moment, it is undoubtedly predicting that the losses of the American labour market in April will be deeper than what was recorded in the 2008 crisis, and we can estimate those losses by about 26 million jobs, which raises the unemployment rate to 20%, while opinion polls show that unemployment for the month of April is around 16% only.

The losses are expected to be particularly concentrated on low-wage employment and laborers working for fewer hours, which will be reflected in the average hourly wages data, with an expected rise of 1.5%. This may cause the average hourly wage to rise on an annual basis to 4.6%, from 3.1% in the previous month.

As for the sectoral impact of the report, it is expected that job losses will rise in all economic sectors without exception, but the losses will be deeper in retails, entertainment and hospitality sectors.

Accordingly, the markets are awaiting in particular the monthly report of the US labour market data, which will give us a more realistic view of the US economy, which will enable the markets to assess this reflection on the quarterly reading of GDP growth in the second quarter.

As for market movements, if the report holds data worse than the average market expectations expected, then it will definitely push the markets to re-evaluate the impact of the current crisis on the economy, and to re-evaluate the impact of the stimulus measures and the economy’s response to these measures – in terms of the time factor – which will put us all facing the ugly truth; that what we have lost since the beginning of this crisis may take a much longer period of time than our expectations in order to put the economy back on track.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.