X Open Hub refines economic calendar and charts in new platform release

X Open Hub, one of the FX industry’s most comprehensive software providers, has made substantial upgrades to its platform in the latest release

FX and OTC derivatives trading software provider X Open Hub has announced its second major platform release of the year, with what the company describes as some exciting new features and enhancement.

Among other enhancements, the economic calendar has new navigation and separate filters. In order to look for events, you can either move day by day or choose a day directly from the calendar. Additionally, you can narrow your search by using filters. Then in the mini-calendar, only days with corresponding content will be highlighted. “No events” info indicates that your filters do not match any events on a particular day.

Additionally, when drawing a trend line or a shape, traders can hold [Shift] to enable the new magnet function. It will significantly help to pin the drawing to Open/Close or High/Low of a candle.

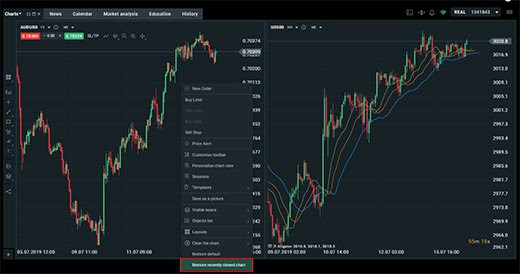

Charts – restore the recently closed chart

When traders right-click on charts in the bottom they can find an option to re-open recently closed charts.

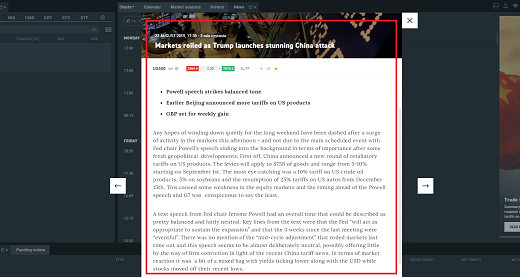

New layout for news section

The news section has been redesigned and is available in a completely new form. The News module is divided into 2 sections: Market news and Traders Talk (in the default disabled). All news will be assigned to 9 different tags which work as filters. On the analysis screen which refers to a specific instrument, you can directly open a trade, chart or instrument info.

“Our mission at X Open Hub is to help you ensure the success of your business. If you have questions or need further assistance regarding new platform release, please do not hesitate to contact your account manager” said a spokesman for the company today.