PrimeXM reports mixed trading volumes for October 2021

PrimeXM has reported mixed trading volumes for October, in line with other institutional and retail platforms that saw the activity of their clients mostly unstable, compared to earlier this year when the coronavirus pandemic stocked unprecedented volatility across varying asset classes.

The provider of FX bridge aggregation and institutional hosting solutions today revealed an average daily volume (ADV) of $52.38 billion, down 6 percent month-on-month from $55.78 billion, reported back in September.

Having hit a record $1.23 trillion in September, total turnover at PrimeXM took a step back in October, coming in at $1.1 trillion, or 10.6 percent less than from where it was the previous month.

The highest daily trading volume of the month was recorded on October 6 with $62.09 billion turnovers.

The total number of trades also spiked by nearly 20 percent over a yearly basis, coming in at 30.22 million transactions compared to just 25 million in October 2020. However, it was virtually unchanged relative to where it had been in September.

A notable strength in PrimeXM’s operational metrics was seen across its Gold instrument XAUUSD, which saw its monthly turnover jumping 9 percent to $312.2 billion. This was the highest point of activity for the yellow metal so far in 2021.

XAU/USD accounted for 28 percent of the overall traded volume, followed by US30 index as the 2nd most traded instrument with $170 billion exchanged hands in October. EURUSD took the third position (13.2% of all volume) with $147 billion in monthly turnover.

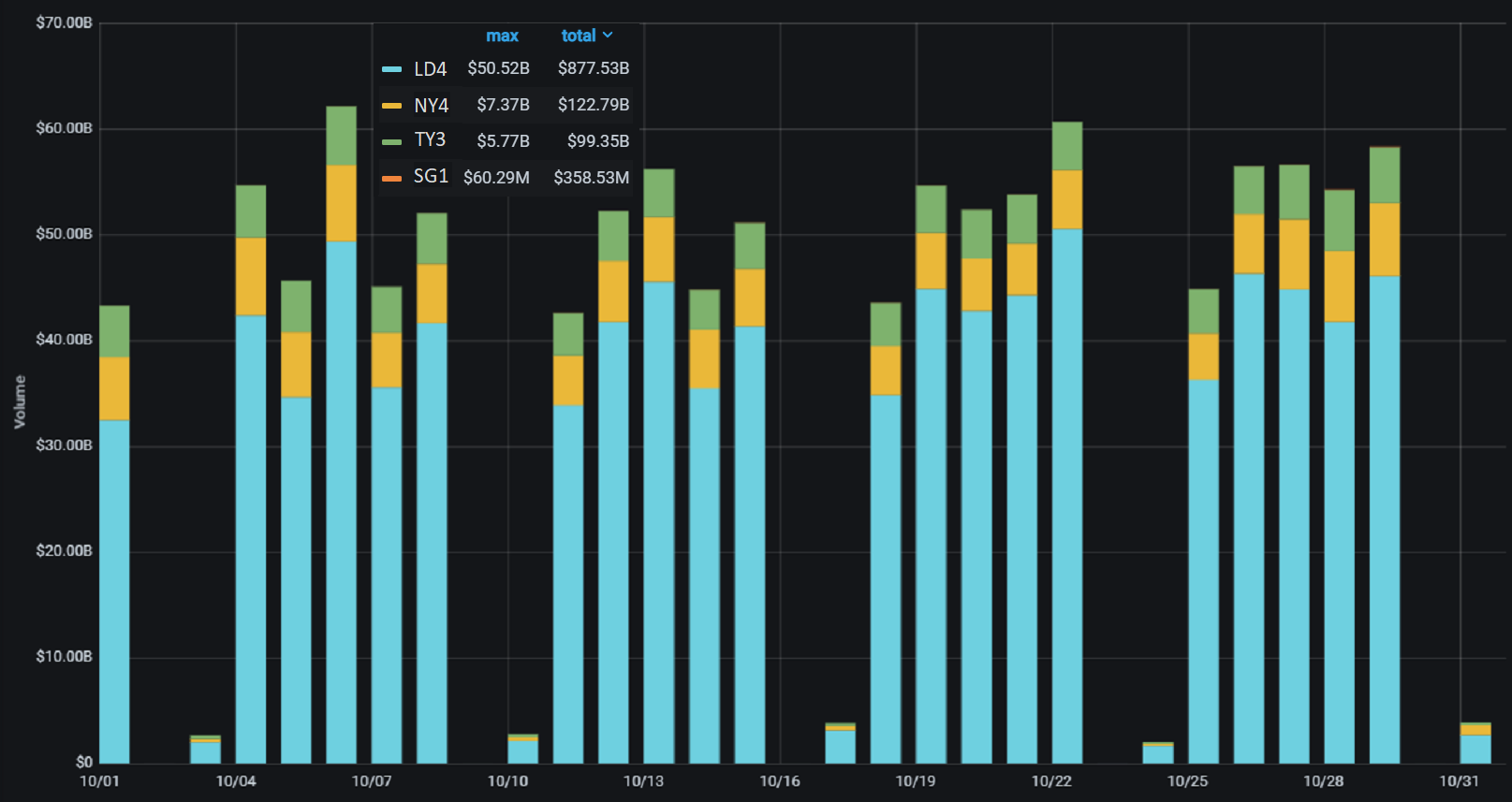

Other business highlights show that London LD4 was the strongest across its four major data center locations, with 80 percent of trades exchanged hands there, more than $877.53 billion in notional value.

Another $122.79 billion has passed through PrimeXM’s New York hub while the data center in Tokyo has processed $99.35 billion. The newly established SG1 data center had seen more than $359 million in trading activities.

PrimeXM’s flagship platform, XCore, offers low latency order routing and pricing engine, giving the institutions the opportunity to connect to a wide range of liquidity providers. Furthermore, XCore is installed in PrimeXM’s infrastructure in Equinix data centers, allowing for the efficient management of the entire brokerage business in a centralized environment.

In addition to their primary product XCore, PrimeXM offers hosting services in the most popular data centers used by the FX industry, such as Equinix LD4, NY4, and TY3, which enables clients to house their trading systems and algos in co-location to their execution engine and liquidity providers.