PrimeXM’s volume hits new all-time high at $1.23 trillion

Average daily trading volumes across PrimeXM data center locations surged by over a third to a new record last month amid broad growth across different asset classes, the Swiss-founded technology company said today.

During November 2021, PrimeXM reported an average daily volume (ADV) of $55.92 billion, which represented a jump of 7 percent month-on-month from $52.3 billion reported back in October. The highest daily trading volume of the month was recorded on 26th November with $76.35 billion turnovers.

In terms of total turnover at PrimeXM, the last month showed a record $1.23 trillion in monthly trading volume, which was 12 percent higher month-on-month from $1.1 trillion in October 2021. The figure is a new all-time high, besting the previous record set back in September at $1.22 trillion. It was also up 34 percent from $919 billion in November 2020.

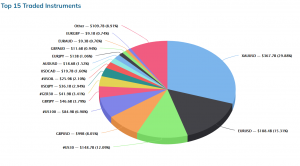

Of this figure, trading on Gold instrument XAUUSD accounted for 30 percent or $367 billion of the overall traded volume. This was the highest point of activity for the yellow metal so far in 2021.

EURUSD turnover climbed in November and replaced the US30 index as the 2nd most traded instrument with $188 billion which was a significant jump from the previous month’s $147 billion.

The US30, otherwise known as the DJ30 derivative contract, took the third position (12.0% of all volume) with $148 billion in monthly turnover.

The total number of trades also spiked by nearly 24 percent over a yearly basis, coming in at 31.84 million transactions compared to just 25.64 million in November 2020.

Singapore data center hits a new milestone

Other business highlights show that London LD4 remains the strongest across PrimeXM’s four major data center locations, with 81 percent of trades exchanged hands there, more than $995 billion in notional value.

Another $131 billion has passed through NY4 and the data center in TY3 has processed $102 billion. PrimeXM’s newly established SG1 data center has seen more than $1.7 billion in trading activities in its fourth month since inception.

PrimeXM’s flagship platform, XCore, offers low latency order routing and pricing engine, giving the institutions the opportunity to connect to a wide range of liquidity providers. Furthermore, XCore is installed in PrimeXM’s infrastructure in Equinix data centers, allowing for the efficient management of the entire brokerage business in a centralized environment.

In addition to their primary product XCore, PrimeXM offers hosting services in the most popular data centers used by the FX industry, such as Equinix LD4, NY4, and TY3, which enables clients to house their trading systems and algos in co-location to their execution engine and liquidity providers.