How to protect your corporate FX exposure from British pound volatility

The corporate foreign exchange impact from the UK’s divorce from the EU can be mitigated.

By Jeff Broth. Jeff Broth is a business writer, mentor, and personal finance advisor. He has been consulting for SMB owners and entrepreneurs for the past seven years

The Brexit vote took place in 2016 and became official and final in early 2021. Enterprise owners should have taken advantage of the time gap and prepared for the eventual reality where the United Kingdom fully removes itself in all aspects from the European Union.

Those who didn’t plan for 2021 need to understand it isn’t too late to navigate through the new regulatory changes, business practices, and prepare for the British pound that could move in either direction and cause headaches for corporate FX managers.

Perhaps most important for unprepared entrepreneurs is to consult with foreign exchange services for corporate clients to understand how they can protect themselves against foreign currency fluctuations.

Brexit 101: Business FX Got A Bit More Complicated

Regardless of where one stands on the Brexit debate, it is important to realize it has completed its path from a political ideology into a new rule of law. Transacting with European partners has changed and enterprises need to be aware of new rules on exports, imports, tariffs, data, hiring, and much more.

Fortunately, UK enterprise owners can continue selling their goods to European customers without tariffs or quotas. Some products may require special licenses and certifications while other products will be labeled in specific ways.

Enterprise owners will likely find the new paperwork to be an unnecessary distraction and a waste of their time — but it must be done.

UK citizens have lost their rights to freely move to an EU country. So owners that were looking to relocate their business or work remotely from warmer climates in certain EU countries for more than 90 days may find it more difficult to do so than before.

However, the UK will be able to negotiate new trade agreements however it sees fit with other countries, including the United States.

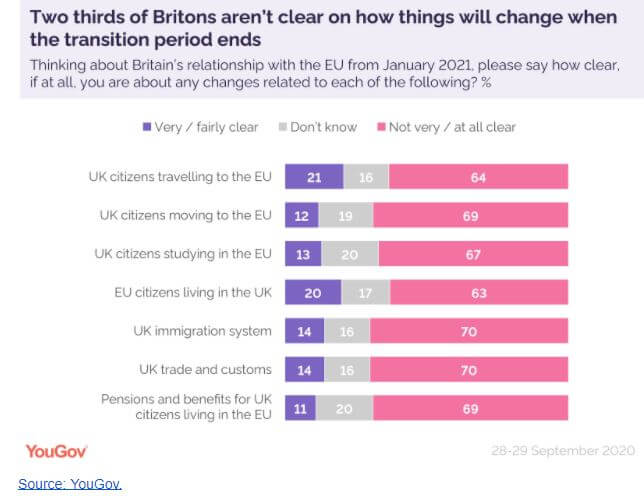

And if you are still unsure what the environment will be like in 2021 and beyond, don’t worry because you are far from alone in fully understanding your business FX risks and exposure.

Why Pound Fluctuations Matter

By the UK government’s own admission, the Brexit process which officially began on Jan. 1, 2021, will go through “bumpy moments.” No one would expect otherwise as the status quo of nearly 50 years of UK membership in the European bloc comes to an end.

With that said, what impact will Brexit have on the British pound in 2021 and beyond?

First, it is important to discuss why this could impact anyone and everyone that does business with the EU and elsewhere.

A falling pound makes UK-made goods cheaper abroad because the international client benefits from a more favorable exchange rate. Also, UK companies that cater to tourists should see a boost as a weaker pound means tourists can exchange their home currency for more pounds.

But on the other hand, a weaker pound means enterprises that rely on imported goods from Europe or elsewhere will have to pay more by default of an inferior exchange rate. Some owners may have no choice but to pass on the higher costs to the consumer and this is never good for anyone.

A weaker pound can also translate to a reduction in capital flows. Foreigners may hold off investing in UK businesses or opening new offices if they face unnecessary foreign exchange risks.

The same logic that a strong pound benefits some segments of the economy at the expense of others is just as true. Corporate foreign exchange managers need to take a close look at their business and truly understand how a strong and weak pound will impact their bottom line.

A very high volume enterprise operating at thin margins could be devastated by a 5% move in the wrong direction. Other enterprises might be able to survive in an unfavorable foreign exchange environment but it might be the difference between expanding and hiring new workers and laying off part of the staff.

So, which one is it? A strong or weak pound? Depends on which expert you ask.

Nomura foreign exchange strategist Jordan Rochester commented in a research note: “If 2021 is the ‘return to normal’ trade then the UK is currently one of the worst affected countries in the G10 and thus may experience one of the biggest recoveries,”

Taking the other side of the pound trade, Head of Market Analysis at Monex Europe Ranko Berich said: “The uninspiring Sterling reaction to confirmation of a trade deal is looking like a classic case of ‘buy the rumour, sell the fact’. After weeks, months, and years of back-and-forth, it seems the confirmation of the deal was mostly as expected by markets and as such is not a game changer for sterling. Other factors, most importantly Covid-19, will now once again begin to drive the outlook for the Pound.”

Hedge Your Corporate FX Exposure

Forward contracts are one of the few tools available to owners that are designed to protect their foreign exchange exposure. A forward contract gives the holder (be it an individual or enterprise) the right to buy or sell a currency pair at a predetermined exchange rate on a set date.

Suppose an enterprise owner knows they will need to spend 1 million euros in 12 months to import goods. At current exchange rates, this translates to 904,000 pounds.

An unfavorable currency fluctuation of just 5% over the next year means the same import will cost nearly 950,000 pounds. And if the pound loses 7%, 1 million euros will cost 967,280 pounds.

Many enterprise owners don’t have an extra 45,000 pounds sitting around in the bank to spend.

Instead, a forward contract can eliminate foreign exchange uncertainty. The enterprise owner will enter into a one-year forward contract with a counterparty where an exchange of 904,000 pounds for 1 million euros will take place, regardless of the actual exchange rate in one year.

Conclusion: Think Smart

If the currency pair moves in a favorable direction the enterprise owner will still need to honor their end of the transaction.

Sure, their business foreign exchange position would have been better off by not taking out a forward contract. But an enterprise owner needs to focus on their core business and not engage in currency speculation. For many, the downside scenario of paying an extra 45,000 pounds is an unacceptable risk that must be removed through corporate FX hedging.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff. Feature image courtesy of Pixabay.