Q3 2020 marks IG’s strongest revenue quarter since implementation of ESMA restrictions on CFDs

Revenue in the quarter to end-February 2020 was £139.8 million, 29% higher than in the same period in the prior year.

Online trading major IG Group Holdings plc (LON:IGG) today issued an update on its revenue for the three months to February 29, 2020 (“Q3 FY20”).

IG reports strong business performance during the third quarter supported by a significant increase in active clients and reflecting increased client trading activity, particularly in the last week of February when financial market volatility was exceptionally high.

Revenue in Q3 FY20 was £139.8 million, 29% higher than in the same period in the prior year. Q3 FY20 was IG’s strongest revenue quarter since the implementation of the ESMA product intervention measures in August 2018 and is the third highest quarterly revenue in the Group’s history, exceeded only by the last two quarters of FY18.

The Group served 101,700 OTC leveraged active clients in the quarter, 21% higher than in the same period in the prior year, with average OTC leveraged revenue per client 9% higher than in the prior year, at £1,330.

This client execution benefit is generally higher in more volatile market conditions, and the conversion of client income to net trading revenue in Q3 FY20 was 70%, compared with the approximately 74% conversion in H1 FY20 and in FY19 and FY18.

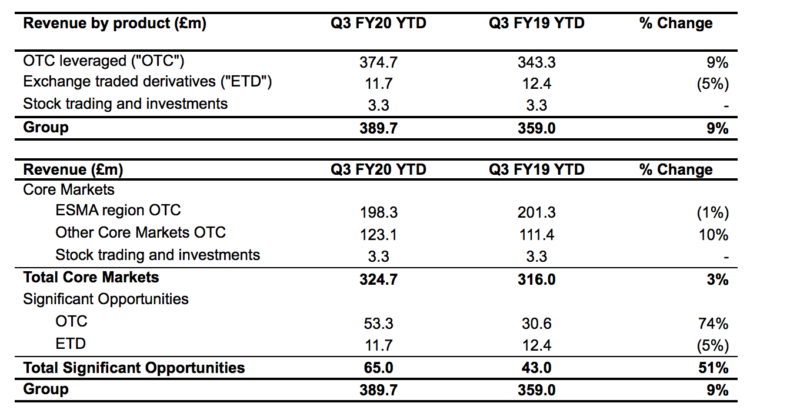

Year to date net trading revenue of £389.7 million is 9% higher than in the same period in the prior year. Revenue in the Group’s Core Markets is 3% higher, with revenue from the Group’s portfolio of Significant Opportunities 51% higher.

ESMA region revenue in FY20 is 8% higher, driven by a 7% increase in the number of active OTC leveraged clients.

Year to date revenue in the Other Core Markets is 10% higher than in the prior year, driven by a 7% increase in the number of active OTC leveraged clients.

The 74% growth in OTC leveraged revenue from the Group’s portfolio of Significant Opportunities reflects the strong performance in Japan and Emerging Markets on the back of the increase in the number of active clients in those businesses.

The Institutional business has increased its active client numbers by over 40%, and the Group’s new US OTC FX business has served over 4,000 active clients this year.

Conditions were more challenging in the US Exchange Traded Derivatives business, Nadex, where client numbers were 8% lower.

Regarding the spread of the COVID-19 virus, IG says it has implemented a comprehensive business continuity plan, which is operating as anticipated. All employees have the capability to work from home and IG will continue to provide the best possible service for its clients when they choose to trade the financial markets.

In terms of current trading, the company notes that the high level of volatility in the last week of February has continued into March. Revenue in the first 12 trading days of the 61 in Q4 FY20 is estimated to be around £52 million.