Quebec’s Tribunal orders fail to stop ICO scammers CreUnite

Facebook promotion of CreUnite’s activities continues in the face of orders issued by Quebec’s Financial Markets Administrative Tribunal.

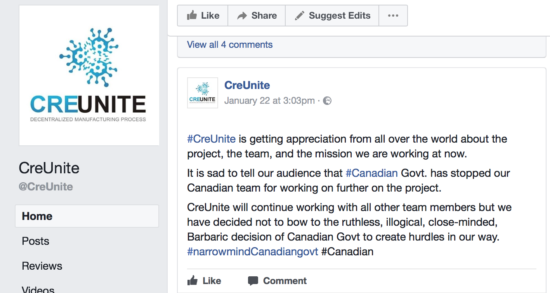

Despite the orders issued by Quebec’s Financial Markets Administrative Tribunal (TMF), ICO scammers CreUnite continue to promote their project via social networks, calling the decision of the Canadian authorities barbaric.

Earlier this month, TMF issued a set of restraint orders against CreUnite, Dominic Longpré (also known as Steve Long), Ian Pierre Lajoie, Robert Ste Marie, Martin Champagne, Clinton van der Linden, Gabriel Beaupré, Asad Zeeshan and Nahel Aouane. The decisions were made due to the defendants’ activities related to investments in CreUnite via the acquisitions of tokens labelled as CUT, virtual currency that the defendants promote.

None of the above-mentioned individuals and entities has any registration with Quebec’s financial markets authority (AMF).

The Tribunal has issued orders prohibiting the defendants from all investment activities, including any targeting of investors in Quebec and from Quebec. The TMF has also ordered the closure of the website of the company and all of the social networking pages associated with the advertising and promotion of CreUnite.

At the moment of publication of this article, the Facebook page of CreUnite is still up and running. Moreover, the people behind the ICO vow to keep up their activities.

TMF continues to battle ICO scams. It has recently extended the restraint order against PlexCorps, PlexCoin, DL Innov inc., Gestio inc., Dominic Lacroix, and Sabrina Paradis-Royer, accused of running a virtual currency scam. The order is now extended until May 17, 2018. The defendants are prohibited from disposing or making use of any funds, securities or other assets that are entrusted to them or that they have in possession.

In the meantime, the US authorities have also taken action against PlexCoin and the entities associated with it. In early December, the US Securities and Exchange Commission (SEC) launched a lawsuit against PlexCorps aka PlexCoin and Sidepay.ca, Dominic Lacroix and Sabrina Paradis-Royer at the New York Eastern District Court.

In its complaint, the US regulator says that it has to take an emergency action to stop Lacroix, a recidivist securities law violator In Canada, and his partner Paradis-Royer from further misappropriation of investor funds illegally raised through the fraudulent and unregistered offer and sale of securities called “PlexCoin” or “PlexCoin Tokens” in a purported “Initial Coin Offering”.