Questrade rolls out new mobile trading application

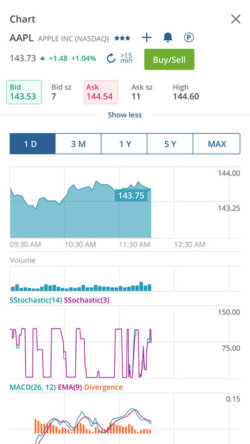

The Questrade Mobile application allows traders to place stock and options trades in real time, as well as withdraw funds and view account details.

Canadian brokerage Questrade has been promising its clients a new mobile application at least since the summer of 2016 and the promises have finally materialized into a particular product this week. The Questrade Mobile application is now available on the iTunes store for owners of iOS-powered devices and on Google Play for owners of Android-based gadgets.

The Questrade Mobile app lets clients of the broker to place both stock and option trades in real time, as well as keep an eye on their investment details. They are also able to withdraw funds or transfer between Questrade accounts. The application also enables users to manage their account details.

The Questrade Mobile app lets clients of the broker to place both stock and option trades in real time, as well as keep an eye on their investment details. They are also able to withdraw funds or transfer between Questrade accounts. The application also enables users to manage their account details.

There are just a handful of reviews of the application, which is normal for a solution whose first version has just been released. Some users complain about the application being a bit sluggish but overall the reviews are positive, especially with regards to the design of the solution.

The launch of the new mobile app by Questrade makes perfect business sense, if a broker wants to target contemporary traders who need to keep an eye on the market developments, monitor their investments and trade on the go.

Moreover, other companies that actively target Canadian traders, such as Interactive Brokers, regularly update their mobile applications. In fact, Questrade faces tough competition in this respect – Interactive Brokers’ solution offers traders to make use of an artificial intelligence (AI) solution, the IBot, that responds to queries and even supports voice recognition.

On a global scale, the online trading companies that invest in the development of mobile applications are numerous. A notable example is Swissquote, which has been pushing the boundaries of mobile fintech – in June 2015, Swissquote became the first Swiss bank to roll out an application for Apple Watch. The most recent Swissquote push into the world of mobile fintech concerns virtual reality. In February this year, the company launched a new virtual reality trading application.