Questrade teams up with Sharesight over stock portfolio tracking

Questrade clients are now able to import their historical trading data into stock portfolio tracking service Sharesight.

Canadian online trading company Questrade has teamed up with stock portfolio tracking expert Sharesight. As a result, the clients of the broker may import their historical trading data into Sharesight.

Thanks to Sharesight, traders get automatic updates on their stock portfolio, as the service adjusts the holdings data with daily price & currency fluctuations and automatically incorporates company actions such as dividends and share splits into one’s portfolio. The tracker also aims to deliver better understanding of the stock’s performance. Brokerage fees, capital gains, corporate actions and currency fluctuations all factor into this performance. Sharesight’s annualised calculation methodology provides data-driven insights to assist traders in making better investment decisions going forward.

In addition, Sharesight provides traders with the tools to figure out their obligations at tax time – including the ability to securely share portfolio access directly with one’s accountant or financial advisor.

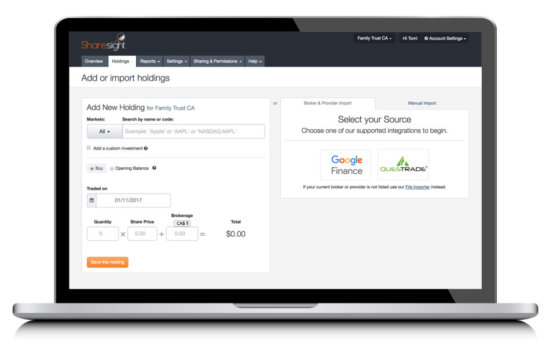

To import one’s Questrade trades into Sharesight, one has to sign up for a Free Sharesight account, download the historical trading data from Questrade, and import it into Sharesight using a dedicated uploader. When the trades are loaded, Sharesight will automatically backfill most corporate actions that occurred (such as dividends and share splits).

For the time being, Questrade clients will need to manually add their future share trades. But Sharesight says it is working on an API integration with Questrade, which will allow future trades to be automatically synchronised to Sharesight.

Talking of new functionalities for Questrade clients, let’s note that a couple of weeks ago the broker released an updated version of its platform IQ Edge. A new time-saving feature is added that allows traders to extend the expiry date of their options positions in one step. With this feature, they can create rollover orders for single-leg options or any two-leg option strategies belonging to same underlying security. Also, all margin account holders can now view their real-time maintenance excess (RTME) in either combined CAD or USD. This addition makes it easy to check if a trader is in a margin call right from the Summary or Position tab.