Regulators eye HFT: UK FCA publishes paper and Japan plans to change rules

Regulatory authorities around the world are looking further into high frequency trading as one of the remaining issues to be firmly addressed, as critics amount suggesting HFT had something to do with the volatile way financial markets were traded at the beginning of the year. UK FCA rather ‘inconclusive’ study on HFT Today, the […]

Regulatory authorities around the world are looking further into high frequency trading as one of the remaining issues to be firmly addressed, as critics amount suggesting HFT had something to do with the volatile way financial markets were traded at the beginning of the year.

UK FCA rather ‘inconclusive’ study on HFT

Today, the UK Financial Conduct Authority (FCA) has published a paper regarding the matter, using a novel dataset with full order-book data on 120 stocks traded on UK venues LSE, Bats and Chi-X for the year 2013, which accounted for 85% of all FTSE on-exchange traded volume.

The first comment regarding possible ‘predatory activity’ in the paper authored by Matteo Aquilina and Carla Ysusi was: “We do find patterns consistent with HFTs being able to anticipate the order flow over longer time periods (seconds and tens of seconds). This is particularly true for those market participants that adopt “pure” non-HFT strategies (i.e. those participants that do not use low-latency technology).

However, we cannot say whether this is due to HFTs reacting more rapidly to new information, or to order-flow anticipation. Furthermore, when looking at specific non-HFTs (something that market participants themselves cannot do as the orders they see are anonymous), we find evidence that a number of them send some of their orders in a somewhat predictable way, by sending them a few milliseconds apart on a regular basis.”

In a quick conclusion of the roughly inconclusive study, “HFTs appear not to anticipate near-simultaneous orders (…) but they could be predicting the flow over longer time periods”. Confirming previous studies, the document found that high frequency trading represented 27% of the traded volume and 39% of the volume of orders in the lit. The paper can be read here.

Japan’s Financial System Council meeting and the 60% figure

In April 8, the Minister of Japan’s Financial Services had announced at a press conference that a general meeting would take place this month to address disrupting issues such as blockchain technology and high frequency trading.

Although, HFT is not as new as the distributed ledger technology, Japan hasn’t made much to regulate that practice, which in the eyes of the regulatory authorities, is putting financial markets at risk, causing unfair advantage to high frequency traders and causing stock stock price to gyrate, as automatic trades based on algorithms by hedge funds among others can play off each other and create a feedback loop that amplifies price movements.

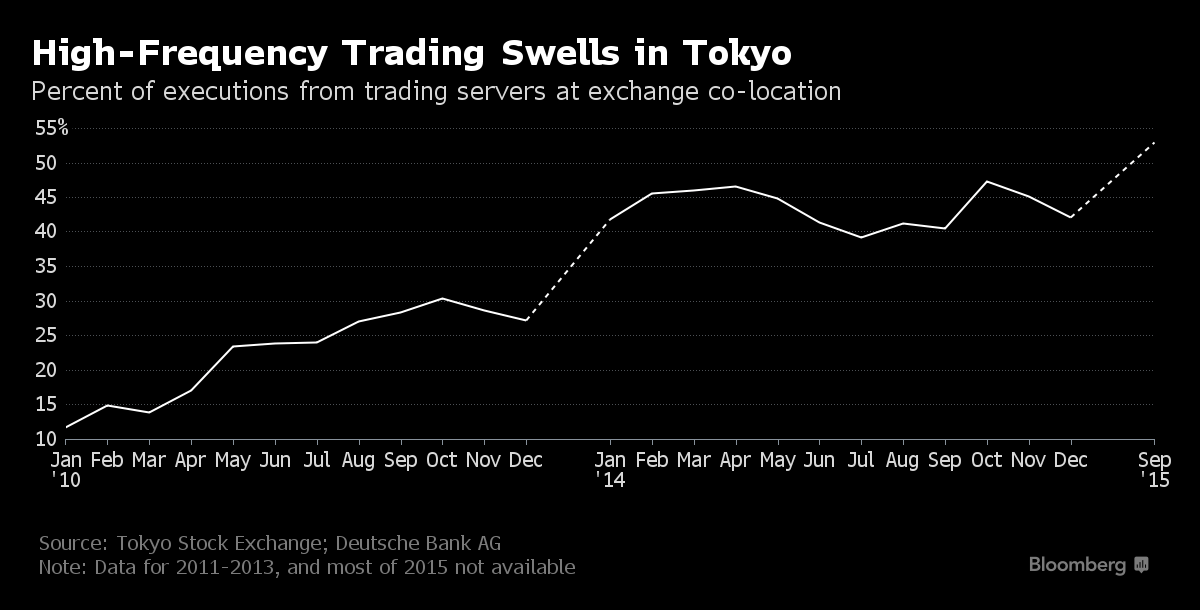

HFT contribution to recent market volatility is not out of the question for Japan’s FSA, as well as the effect on the long-term market value of listed companies, distorting price formation in the markets. In the case of Japan, high frequency trading accounts for about 60% of all transactions on the Tokyo Stock Exchange, as the lighting-fast technology can even execute 1,000 per second.

Source: Bloomberg

Calling for efficiency, transparency and stability of the markets, Japan’s Finance Minister Taro Aso will await the Financial System Council’s report by the end of April, possibly leading to a revision of the financial instruments and exchange act and following Europe’s regulatory changes to come in force in 2018 that will require HFT operators to first register with the authorities and improve their trading systems. The U.S. is also looking at the issue and legislative changes are expected soon.