Research: What FinTech and electronic trading firms look for when recruiting senior executives and approaching M&A deals

AIMS International senior executive Torsten Miland looks closely at how the “old” financial institutions are increasingly trying to either acquire these start-ups or actually fund them at an early stage, and what leadership qualities are in high demand within modern electronic trading and FinTech companies

By Torsten Miland, Head of Global Team for Financial & Professional Services, AIMS International

Will the emergence of the Fintech Industry and the subsequent disruption really change the world of Finance?

Imagine if you had decided you wanted to build a bank. Where would you start? Would you acquire a big head office and a number of places where you could place offices for clients? Or would you – more likely and smarter – start a bank by building an app?

This dilemma is what faces modern banks today. Many of them still have branches and maintain a physical relationship with their clients – even if they know that most of the clients are really not interested in visiting the bank to do their banking.

The needs from both individuals and companies for financial services has changed. Why would you want to borrow money from a bank, when you via an app can get the loan from the community around you? Why would you call your broker and ask him to invest for you, when you can cut out the middleman and do it yourself from an app?

And these are some of the reasons that FinTech is growing at a phenomenal rate.

Young companies are taking over from old financial institutions

One of the most successful FinTech companies in the world, Saxo Bank, is no more than 15 years old. Most Fintech companies are much younger than that. And at the moment we are seeing new FinTech companies being established at a very high rate.

It is estimated that global investment in financial technology increased more than twelvefold from $930 million in 2008 to more than $12 billion in 2014.

According to London & Partners (The official promotional company for London) more than 45.000 people work in London in the FinTech industry – a number bigger than anywhere else in the world.

PriceWaterhouseCoopers expects that 25 % of the global insurance- and asset management business in just 4 years from now will have moved from the traditional banking institutions to FinTech-players.

What is a FinTech company?

Financial technology companies are IT start-ups or already established technology companies trying to replace or enhance the usage of financial services of incumbent companies.

FinTech companies comes in many varieties and sizes. They are often headed by quite young people with a brilliant mind and a head for business.

The “old” financial institutions are increasingly trying to either acquire these start-ups or actually fund them at an early stage.

FinTech is innovating within new applications, processes, products or business models and the potential for doing things in a new way are endless. The areas FinTech usually is believed to cover are:

- Crowd lending/crowdfunding/fundraising

- Blockchain/Bitcoin

- Payment

- InsurTech

- Data Management

- On-line wealth management

- Personal finance).

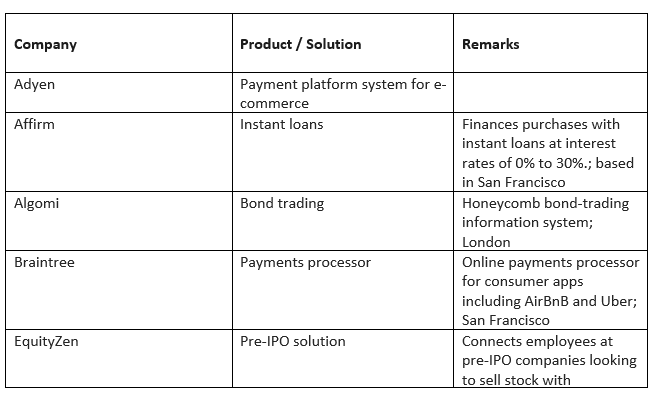

Examples of FinTech companies and their solutions:

And the problem for the traditional banks?

When innovating within the traditional banking sector, these institutions are faced with a number of compliance issues and changes in their legacy-systems. This means that innovation is sometimes slow and even being halted.

Also compliance to legal issues can hinder banks from delivering easy access apps for services. Governments have a natural tendency to regulate banks and other financial institutions, but at the same time the governmental bodies that oversees this area do not always have the insight and competencies to regulate FinTechs.

FinTechs do not have these problems. If they have an idea, normally this idea can be developed very fast, the platform can be available within a short timeframe and the clients are fast adapters. They are also very much under the radar for two reasons; one is that they can establish themselves in off-shore climates with little regulation and the other is lack of insight from government.

So how are the large banking institutions reacting to this?

We are seeing a move toward large, old financial institutions gaining knowledge about FinTech and also acquiring smaller start-ups that have proved that they can gain momentum within a financial field.

Inside the financial institutions we also see that the IT-departments are developing their own services and apps geared towards the same market as FinTechs.

Fortunately, the large banking institutions are not stupid. So the reaction from them will be coming and with even greater force than we have already seen.

An industry expert explains

Andrew Saks-McLeod, CEO of FinanceFeeds.com explains: “FinTech has become not only an integral part of the entire electronic financial services business, but is actually now leading the entire industry forward.”

“The electronic trading business, whether institutional or retail, has a number of key components which range from the Tier 1 banks which provide direct top level liquidity, through to the prime brokerages which aggregate the price feeds using very sophisticated systems, to the liquidity management and integration companies, trade clearing firms and then down to the platform providers” he continued

“At user-level, there are further important components, including signal providers, automated trading and algo developers, copy trading companies and payment processing firms, as well as regulatory technology companies that automate the reporting process” – Andrew Saks-McLeod, CEO, FinanceFeeds

Mr. Saks-McLeod continued “This industry is heading towards where the futures industry was going approximately 10-15 years ago, which is into managed products. Don’t get me wrong, dumb flow will still be there (big margins) but the serious money is looking at FX as a serious alternative asset class and moving into managed products. I see the industry as squeezing margins tighter moving forward.”

“Managed funds and investment funds are another factor. These will be actively managed (frequently traded) and passively managed (macro-economic; taking long term- low leveraged positions). Long term strategies like ETFs in the stock world” he said.

“I believe the large money will be here, and there will be not so much in the retail traded scene in the future.”

Regulatory issues are being addressed – Perhaps this will be the next FinTech?

Andrew Saks-McLeod from FinanceFeeds.com tells us: “In 2016, Corvil, a company that provides network data analytics company for today’s modern, real-time digital industry, concentrating on MiFID II, market infrastructure, security, trading systems and big data, forged a strategic partnership with Abide Financial, which develops automated regulatory reporting systems for EMIR and MiFID II.”

Speaking to FinanceFeeds, Chris Bates, Chief Commercial Officer at Abide Financial explained “Regulatory reporting is effectively a tax on firms, and therefore the value is in getting it right first time, and helping firms avoid investigation, fines and getting publicized for transgressions.”

Taking a look at how technologically advanced the regulatory reporting sector is these days, Mr. Bates said “It has been mentioned more than a few times that regtech is the new fintech.”

“With regard to MiFID, we were licensed in November 2011 to become an Approved Reporting Mechanism (ARM) and are now processing more than 20% of all MiFID transactions. As soon as the window opens we will be applying for ARM2 status which is the MiFID II ARM approval status. There is currently a lot of onus on ARM2 to make sure that everything that we are processing is correct before it gets to the FCA, or other regulatory jurisdiction that a firm may be licensed by. Abide also processes approximately 50% of all EMIR FX transactions.” – Chris Bates, Co-Founder, Abide Financial.

Many regulatory reporting technology companies have recently sprung up in major jurisdictions, those being Cyprus (MAP S Platis), Israel (Cappitech), London (Abide Financial) and New York (Corvil). Corvil is an established technology firm but regtech is a new theme for them.

Liquidity aggregation and prime brokerage

London is the place to be – or?

In London the establishment nestles among the financial giants of the Square Mile, and has done for a substantial period of time – in some cases for decades, however this year, a torrent of newly established prime brokerages and firms offering liquidity has made its way to London.

Hardly surprising, of course, as London is the global centre for Tier 1 bank liquidity provision, as well as for non-bank aggregated liquidity delivered via electronic communication networks such as Thomson Reuters FXall, ICAP’s EBS, or Currenex.

Retail brokerages have never had so much choice with regard to order processing, liquidity management and trade execution methodology.

Many firms, including Danish FinTech and electronic trading company Saxo Bank, have designed a series of tools to optimize their flow to the market and then using that technology to benefit corporate clients which are brokerages.

Companies that do this are able to show the brokerages that use their Prime of Prime service what their flow looks like and how the liquidity providers that they are accessing view their flow.

Many firms in this sector have regular conversations and understand what metrics the sources of liquidity use to evaluate flow and have built similar reporting and analysis themselves so that they can show clients how their flow will be viewed and handled by liquidity providers.

The future?

As we look from the outside at the disruption of the Financial industry it might be easy to think, that if you want to build a bank you can just start a FinTech company and make an app.

But of course this is not what’s going on. Banks have always been able to adapt to the changes in their business environment. They have perhaps not always done it swiftly, but they have survived.

From the standpoint of our business in the talent acquisition and talent manager world, we believe the financial institutions will need more IT-bright talents and the FinTech industry will need more financial-bright talents.

AIMS International operates in over 80 offices worldwide, providing clients with customized, global Executive Search and Talent Management services in 50 countries across all continents.

The company’s distinct structure as an international partnership of top national Executive Search firms enables it to operate with both a global perspective and an in-depth knowledge of the relevant local market.