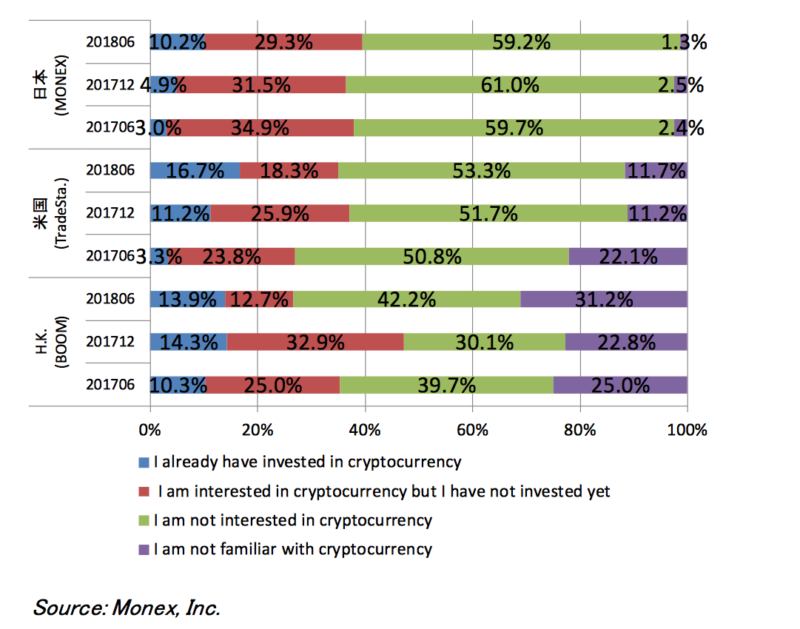

Most respondents in Monex’s global retail investor survey shun cryptocurrencies

The percentage of respondents that are not interested in cryptocurrencies still markedly exceeds the percentage of those that are interested in this type of assets.

Retail investors are still careful when it comes to cryptocurrencies, according to the results of the latest Global Retail Investor Survey conducted among clients of the Japanese, US and Hong Kong businesses of Monex Group, Inc. (TYO:8698).

- The survey shows that 59.2% of the clients of Monex Inc, the Japanese subsidiary of Monex Group, are not interested in virtual currencies. This compares with 29.3% of respondents that are interested in cryptos but have not invested yet. The percentage of those that have invested in cryptocurrencies is 10.2%.

- Among customers of TradeStation, 53.3% are not interested in cryptos, whereas 18.3% are interested but have not invested yet. The percentage of respondents that shun cryptocurrencies has risen since December last year,

- Regarding customers of Monex BOOM Securities (H.K.) Limited, 42.2% of them are not interested in cryptos, compared with 12.7% who are interested in this type of investments but have not invested in cryptos. The percentage of retail investors who shun cryptos has risen markedly from December last year.

Monex says one possible explanation of the results is that the virtual currency market has already peaked.

The survey was conducted from May 28 to June 4, 2018 among the customers of Monex Inc, and from May 29 to June 1, 2018 among customers of TradeStation Securities, Inc. and Monex BOOM Securities (H.K.) Limited. The poll was carried out online.

Let’s recall that Monex is planning a push into the cryptocurrency business. In April this year, the broker finalized the acquisition of troubled virtual currency exchange Coincheck. The deal, which covers 1,775,267 shares in Coincheck, is valued at JPY 3.6 billion.

Monex has noted that Coincheck has received a business improvement order from the Japanese regulator concerning the theft of cryptocurrency, NEM, as a result of unauthorized access to its system on January 26, 2018. But the broker said it would aim to build a secure business environment for customers by fully backing up Coincheck’s enhancement process. In particular, Monex stated its intentions to maximize the use of its expertise and human resources of business administration, system risk management, and customer asset protection system.