Retail Forex broker KVB Kunlun registers sharp rise in profits in H1 2018

The leveraged foreign exchange and other trading income of KVB Kunlun increased by 47.8% to HK$233.5 million in the six months ended June 30, 2018.

In line with a profit alert issued in July, Hong Kong-focused retail Forex broker KVB Kunlun Financial Group Ltd (HKG:6877) has earlier today posted a range of robust metrics, bolstered by high market volatility during the first half of 2018.

The broker noted that, during the six months ended June 30, 2018, the overall market volatility increased slightly when comparing to the first six months in 2017. The most popular traded products by KVB Kunlun’s customers were EUR/USD, USD/JPY, GBP/USD and gold.

The total income of the broker increased by 55.4% to approximately HK$306.2 million in the first half of 2018, up from HK$197.1 million for corresponding period a year earlier. The leveraged foreign exchange and other trading income of KVB Kunlun reached HK$233.5 million in the six months ended June 30, 2018, up 47.8% from approximately HK$158.0 million for registered during the equivalent period in 2017. The increase was mainly attributed to the higher trading volume during the first half of 2018 as compared to the first half of 2017.

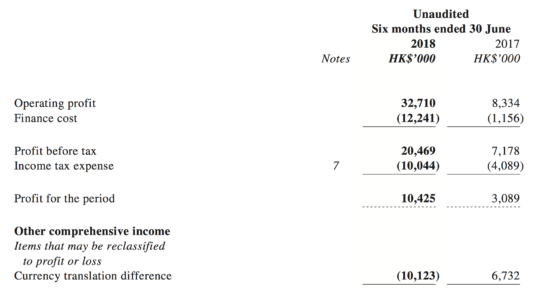

The broker recorded a net profit of approximately HK$10.4 million for the six months to end-June 2018 compared with a net profit of approximately HK$3.1 million for the first six months in 2017. The net profit margin for the first half of 2018 was approximately 3.4%.

The broker notes that, on February 12, 2018 (the “Issue Date”), it issued 7.5% convertible bonds with an aggregate principal amount of HK$200 million to BC Global Fund SPC – BC Fintech Fund SP and PA Investment Funds SPC for the account of PA High Technology Fund SP. The Bonds will expire at the second anniversary of the Issue Date. The net proceeds from the issue of the Bonds is approximately HK$199.28 million. The broker plans to use the net proceeds for investment in financial assets and working capital purposes.