Retail FX brokerage Trading Point heads to the US as Trading.com Markets with NFA application

Trading.com Markets, formerly known as Trading Point US Inc, has appointed XM UK director Charalambos Panayiotou as CEO and Director of the new New York-based entity as the firm becomes the first MetaTrader broker to apply to enter the US market since the mass exodus in early 2013 by many international retail brokerages.

The United States has had the distinction of being the most stable and lucrative market for retail electronic trading customers for many years, ever since the dawn of listed derivatives trading began in Chicago over 250 years ago in the pre-Constitutional colonial period.

For quite some time, FinanceFeeds has advocated the return of good quality and well capitalized international brokerages to the United States market, which was left with just two domestic market companies, OANDA Corporation and GAIN Capital, for several years since the departure of many well-recognized brands almost seven years ago.

During the past few months, a very slight move in the direction of re-establishment in the United States has begun to take place, IG Group having last year re-established its Chicago office with a new National Futures Association (NFA) membership, ready to position itself as one of just three retail giants in a market in which average deposits are $6600 rather than a global average of $3800 and customer lifetime value is three years on average, as opposed to six months.

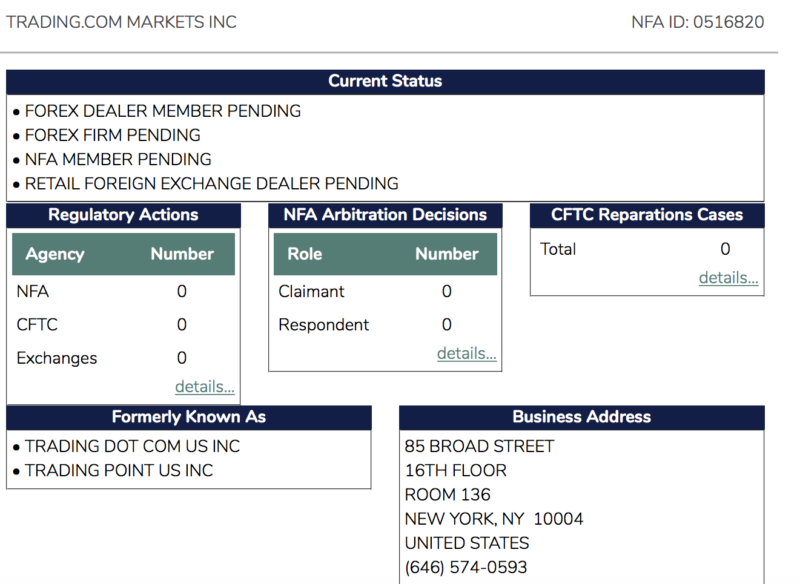

This week, another international retail FX firm has taken the same step, this time Trading Point of Financial Instruments, which has its origins in Cyprus and holds a CySEC license, and has over the years accrued an FCA license in Britain and an Australian ASIC license. The company’s application can be viewed here.

This represents the first entry to the US market by a retail FX firm that does not have its own proprietary platform since the litany of retail companies exited in early 2013, however Trading Point of Financial Instruments is a very large company with substantial revenues, and is among the top five MetaTrader-based brokerages in terms of size, having over 10 MetaQuotes server licenses.

Trading Point of Financial Instruments operates the prominent XM brand, and therefore the firm’s application for an NFA membership represents a significant commercial step.

The NFA membership has been applied for by Trading.com Markets, formerly known as Trading Point US LLC. The application is for Forex Dealer Member (FDM), NFA membership and Retail Foreign Exchange Dealer (RFED) status, dated January 3, 2019.

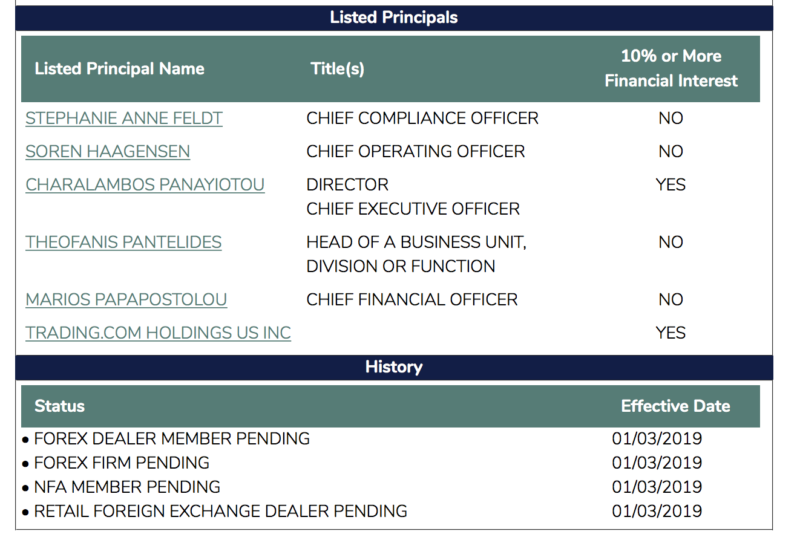

Listed as CEO and Director of the US entities that have applied for NFA membership is Charalambos Panayiotou, who was appointed Director of XM UK in 2016 when the firm launched its FCA licensed subsidiary in London.

Four other Trading Point personnel are listed, in the capacities of Chief Operations Officer, Chief Compliance Officer and Chief Financial Officer.

There is no current indication relating to when or if this membership will be granted, however global aspirations have been part of Trading Point’s commercial direction for some time.

In 2015, the firm was censured by ASIC for providing unlicensed FX services to Australian customers and asked by ASIC to desist from doing so, however shortly afterwards, Trading Point acquired an ASIC license which it still holds today.

The US may well be one of the best, if not the best strategic regions for operating an FX company, but it is also very expensive in terms of operating cost and regulatory capital requirements, as well as a justifiably strict and well monitored jurisdiction.

For those with the wherewithal and resources to get it right, now is a very good time to enter the market, as we said in this video two years ago.