Ripple clarifies role of XRP and Crypto amid Russia ban from SWIFT

Some are saying that Russia could potentially evade sanctions and get around SWIFT using Crypto. Ripple’s GM outlined some of the key arguments refuting this.

As the tragic events in Ukraine unfold, the international community has agreed to ban Russia from SWIFT, which led many to question the role of cryptocurrencies in keeping Russia’s war machine and economy afloat.

Ripple’s XRP comes to mind as a potential substitute not only for its overall popularity in the crypto space but also because it is fast and cheap to settle, unlike Bitcoin.

For that reason, Ripple chief executive Brad Garlinghouse and the RippleNet General Manager Asheesh Birla went to Twitter to clarify the role of XRP and RippleNet.

Issues with tracking, liquidity, and regulation

Ripple CEO Garlighouse said: “To clear any confusion – RippleNet (while being able to do much more than just messaging a la SWIFT) abides by international law & OFAC sanctions. Period, full stop.”

He also pointed to Asheesh Birla’s thread, where he lays out the reality of crypto & blockchain’s role (or lack thereof) to evade global sanctions.

The full transcript of Asheesh Birla’s Twitter thread below:

“In the last few days, we’ve seen some say that Russia could potentially evade sanctions and get around SWIFT using crypto. I outline some of the key arguments refuting this below (and a chart ?)

1. Crypto is only becoming more easily trackable by software and governments

2. . There simply isn’t enough global liquidity to support Russia’s needs (the country’s FX needs, not individuals)

3. on/off ramps are by and large regulated financial institutions that have to abide by OFAC laws

Diving into #2 – our team took a look at the data behind this. As stated by the US Treasury dept – Russia conducts nearly $50B in FX transactions a day. As the largest crypto, bitcoin’s volume is usually between about 20-50B a day. Russia’s needs would encompass BTC and more!

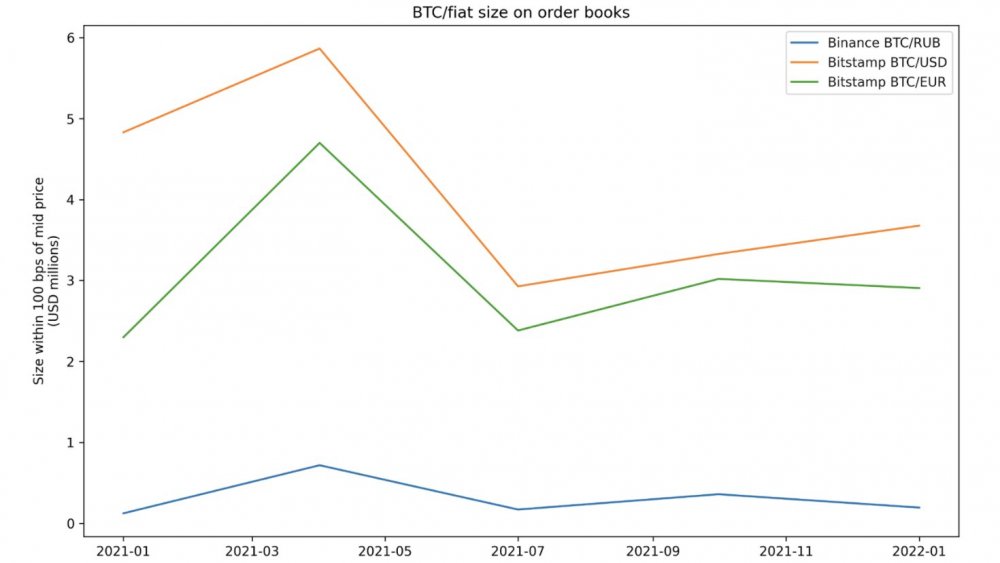

As of January 2022, you could only send ~$200k worth of Russian rubles at a time through BTC on Binance, vs $3.7M through BTC/USD and $2.9M through BTC/EUR on Bitstamp.

Even if you were sending ~$200K every minute & assuming the BTC/RUB market was resilient enough to immediately replenish the liquidity (very doubtful), you’re nowhere near $50B / day. Also, the total average daily volume over the last month for BTC/RUB has been just ~$11M…

SWIFT is one part of the equation here – banning some Russian banks from using SWIFT does complicate matters, but let’s not forget that Russia has had ample time to prepare, setting up direct banking relationships in Asia and elsewhere to get around correspondents.”