Ripple funds Rutgers Law School to reform crypto regulation

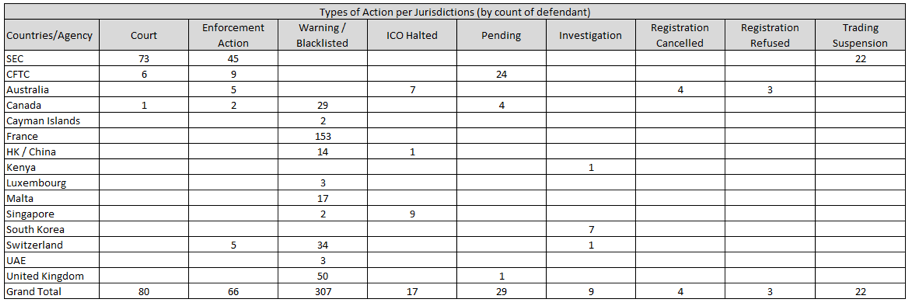

Of the 23 major financial market jurisdictions, nine of them haven’t taken any form of enforcement action against crypto-related companies, and the remaining jurisdictions have a more lenient approach compared to the SEC in a deliberate strategy to appeal to fintech startups.

As the battle between Ripple and the Securities and Exchanges Commission (SEC) intensifies, Ripple Labs has published a blog post pointing to recent research by Yuliya Guseva of Rutgers Law School and her colleague Douglas S. Eakeley, which found the SEC has a higher rate of intervention in blockchain-related cases.

The SEC “brings more enforcement actions against digital-asset issuers, broker-dealers, exchanges, and other crypto-market participants than do regulators in most other major jurisdictions combined”, the paper states.

Acknowledging that the size of the U.S. cryptocurrency market is a contributing factor to the SEC’s high rate of intervention, Prof. Guseva believes the use of the Howey test is a key factor for the SEC action.

The test has been used for more than 70 years to determine whether a transaction should be classified as an investment contract and therefore registered as a security.

The research paper argues that the Howie test is no longer suitable for judging 21st-century innovations as it found that the SEC has departed from its previously clear policy of prosecuting crypto-fraud and protecting investors. It cited Kik, Telegram, and Ripple as examples.

“I am worried about the dynamic inconsistencies in the recent SEC enforcement actions. Together with the broad reach of the Howey test, the inconsistencies in enforcement may exacerbate uncertainty and fail to provide market participants with a clear ex ante understanding of the securities laws”, said Prof. Guseva.

Of the 23 major financial market jurisdictions, nine of them haven’t taken any form of enforcement action against crypto-related companies, and the remaining jurisdictions have a more lenient approach compared to the SEC in a deliberate strategy to appeal to fintech startups.

“[If] the SEC can no longer provide clarity through strategic predictability of a transparent enforcement approach, and if the market finds substantial inconsistencies in the regulator’s moves and strategic commitments, the fabric of cooperation between the innovators and the regulator can be undermined”.

This may lead to firms being less inclined to comprehensively comply with U.S. securities law or seek cooperation with the SEC. So, the SEC should be mindful of its enforcement policies involving fraud or cases concerning opaque regulatory issues.

In the case of digital assets, which can have different utilities or a limited application, a functional approach where one looks at the actual uses and applications of a digital asset may be more appropriate, the paper argues, adding that “law schools have become crucial hubs for debating policies and suggesting doctrinal and regulatory solutions to the industry, the regulators, and other stakeholders”.

Ripple’s University Blockchain Research Initiative (UBRI) is funding the Fintech and Blockchain Collaboratory by Rutgers Center for Corporate Law and Governance headed by Prof. Guseva. The organization gathers academics, regulators, and lawyers to discuss the latest policy issues in fintech and crypto, and most of all, contribute to reform the space.

In just the last 18 months, the U.S. regulator ordered Telegram to stop selling its cryptocurrency, fined Kik Interactive $5 million over issues with its Kin token, and is currently suing Ripple.

The lawsuit against Ripple alleges they aided and abetted Ripple’s unregistered sales of securities, dating as far back as 2013 and 2015 respectively.

In its answer, Ripple stated it had “never offered or sold XRP as an investment” and that “XRP holders do not acquire any claim to the assets of Ripple, hold any ownership interest in Ripple, or have any entitlement to share in Ripple’s future profits.”

In addition, the cryptocurrency firm argued that “utility depends on XRP’s near-instantaneous and seamless settlement in low-cost transactions. Treating XRP as a security, by contrast, would subject thousands of exchanges, market-makers, and other actors in the gigantic virtual currency market to lengthy, complex, and costly regulatory requirements.”