Ripple reveals a taste of advice on XRP as defendants seek full disclosure

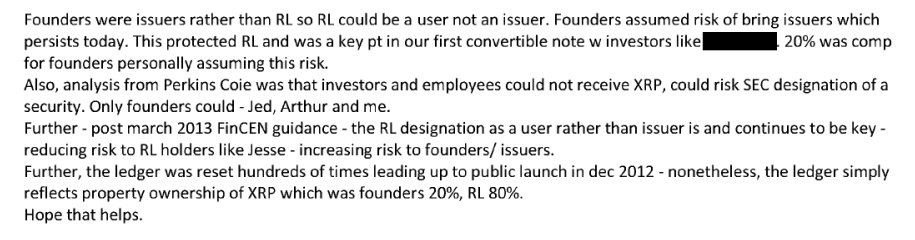

According to Chris Larsen, Perkins Coie LLP said that Ripple investors and employees could not receive XRP as it could risk SEC designation of a security. Only founders could.

Ripple and Chris Larsen do not oppose the unsealing of the legal memos in their entirety, said the defendants’ counsel in a letter to the court.

The documents pertain to legal advice hired by Chris Larsen in order to have a full legal analysis on any potential issues ahead for Ripple in regard to XRP.

“Both documents should be unsealed in their entirety”

Ripple and Larsen support full disclosure to the public with the exception of a small redaction to maintain the privacy of one of Ripple’s equity investors.

“Mr. Larsen believes that, if any part of the Legal Memos is unsealed, then both documents should be unsealed in their entirety so that the public can review the SEC’s characterizations of those documents in their full context.

“For the avoidance of doubt, Ripple’s and Mr. Larsen’s position on sealing is not intended to be a waiver of any evidentiary privilege or protection from disclosure with respect to the subject matter of the Legal Memos. We note that the SEC previously filed proposed redacted versions of these documents, however, after conferring with the SEC, we understand that the SEC agrees to the unsealing of the Legal Memos in their entirety and is not requesting redactions.”

“Next, Ripple and Mr. Larsen are proposing one limited redaction to Exhibit E to maintain the privacy of one of Ripple’s equity investors.”

The one document released for now is Exhibit E, a Chris Larsen email to XRP co-creator Ryan Fugger with the redacted investor name.

No XRP for equity investors and employees

Here, Chris Larsen points to an analysis by law firm Perkins Coie, which allegedly told Ripple that investors and employees could not receive XRP as it could risk SEC designation of a security. Only founders could.

Chris Larsen added. “the ledger simply reflects property ownership of XRP which was founders 20%, RL 80%”.

Exhibit E is evidently not legal advice but is still a taste of the upcoming legal memos as they get released to the public. The evidence also suggests that Ripple executives made efforts not to provoke the SEC by following the advice from Perkins Coie LLP.

Perkins Coie has recently published the “SEC Digital Asset Timeline”, consisting of a timeline of selected digital asset-related SEC guidance, speeches, and enforcement actions issues post-DAO report. This goes to show how the law firm remains very much active within the crypto space.