Ripple stands to win battle over Fair Notice amid SEC’s backfire

The enforcement actions cited in the report do not actually support the SEC’s argument in the first place, Ripple argued.

Ripple has filed its Sur-Reply regarding the SEC’s Motion to Strike the Fair Notice Affirmative Defense to oppose “the SEC’s inappropriate request” for judicial notice and to address the SEC’s “misleading characterization of its prior enforcement actions”.

The SEC has previously asserted that Ripple’s fair notice defense “fails” because, “prior to suing Ripple, the SEC had already brought more than seventy cases that subjected other digital assets to the application of the

federal securities laws.”

The agency also cited the May 2021 report by Cornerstone Research distributed after Ripple filed its Opposition brief and requested the court to take judicial notice of the SEC complaints which the report characterizes as “cryptocurrency enforcement actions.

70+ enforcement actions support Ripple, not the SEC

In response, Ripple stated that a “sur-reply is amply justified here” in order to tackle “the SEC’s inappropriately premature request for this Court to conclude, as a factual matter, that market participants had fair notice that XRP would be considered a security.”

The enforcement actions cited in the report do not actually support the SEC’s argument in the first place, the Ripple counsel argued, adding that “not one of those cases alleged a violation of Section 5’s registration requirements for a sale of digital assets outside the context of an ICO.”

“The Court should deny the SEC’s request for judicial notice and disregard the SEC’s attempt to rely on disputed facts to foreclose a legally cognizable defense.”

In conclusion, Ripple argues that the court may not properly take judicial notice of the Cornerstone Report, the facts it contains are not undisputed; and if the Court were to consider the cases cited in the report, they support Ripple, not the SEC.

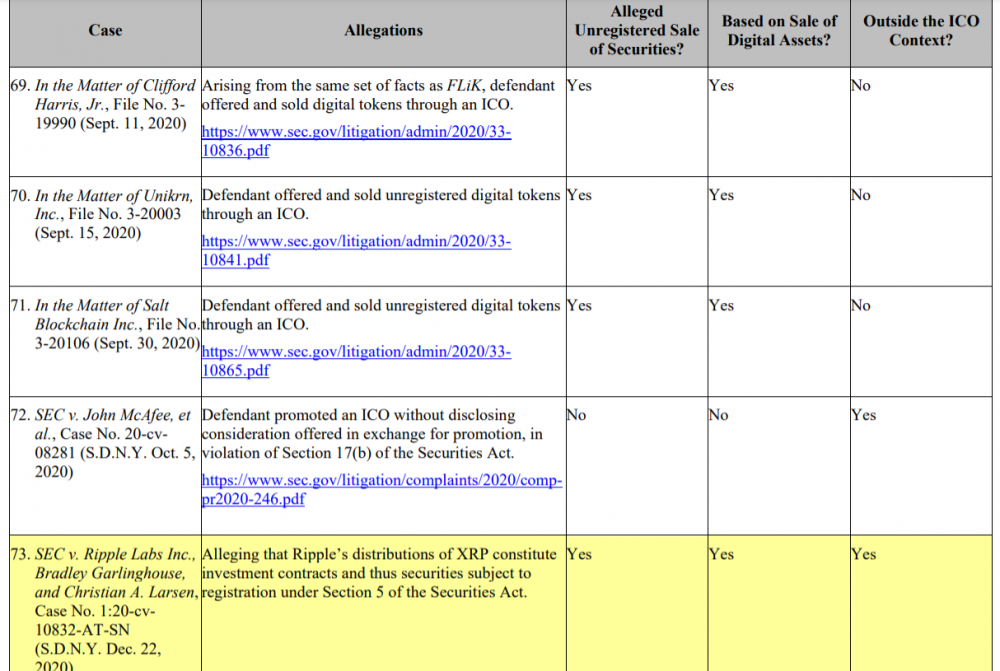

Exhibit A is a list of the 75 cryptocurrency enforcement actions covered by the Cornerstone Report, dividing each action by three categories: “Alleged Unregistered Sale of Securities?“, “Based on Sale of Digital Assets?“, and “Outside the ICO Context?“.

Ripple is the only SEC cryptocurrency litigation that checks all three boxes, thus proving the prior statement “not one of those cases alleged a violation of Section 5’s registration requirements for a sale of digital assets outside the context of an ICO.”

Court to allow Fair Notice defense, Jeremy Hogan predicts

In a Twitter exchange a few days ago, attorney Jeremy Hogan agreed with the prediction that the fair notice defense will be allowed by the court, while charges against Brag Garlinghouse and Chris Larsen won’t be dismissed.

As to charges against Brad Garlinghouse and Chris Larsen, the individual defendants argued the SEC does not plausibly allege that the co-founders knew or were reckless in not knowing that Ripple was violating section 5 or acting improperly.

The motion also argues that the SEC’s first claim fails because it does not allege that their personal offers or sales of XRP occurred in the United States. Even if their conduct in the US were relevant, the transactions in question are predominantly foreign and accordingly outside the scope of Section 5.

Indeed, the Chris Larsen email thread refers to an overseas sale of XRP. It is unclear if the SEC has material against Ripple and the individual defendants that is relevant to the SEC’s jurisdiction.

In the meantime, a JP Morgan report made a claim on why XRP is so correlated with Bitcoin, namely the lack of partners on the Ripple network using XRP for cross border payments. Critics have argued the data is outdated.