Ripple “to the moon”: XRP price explodes to $161 million on technical glitch

For a moment, retail investors were able to smell the Lambo and the paradisiacal islands they did not buy.

A technical glitch has sent the prices of cryptocurrencies “to the moon” for a brief period of time, including XRP, also known by many as Ripple.

Many digital asset investors have taken screenshots of the moment where everyone within the space felt like a trillionaire for a few minutes.

Crypto trillionaires for a day

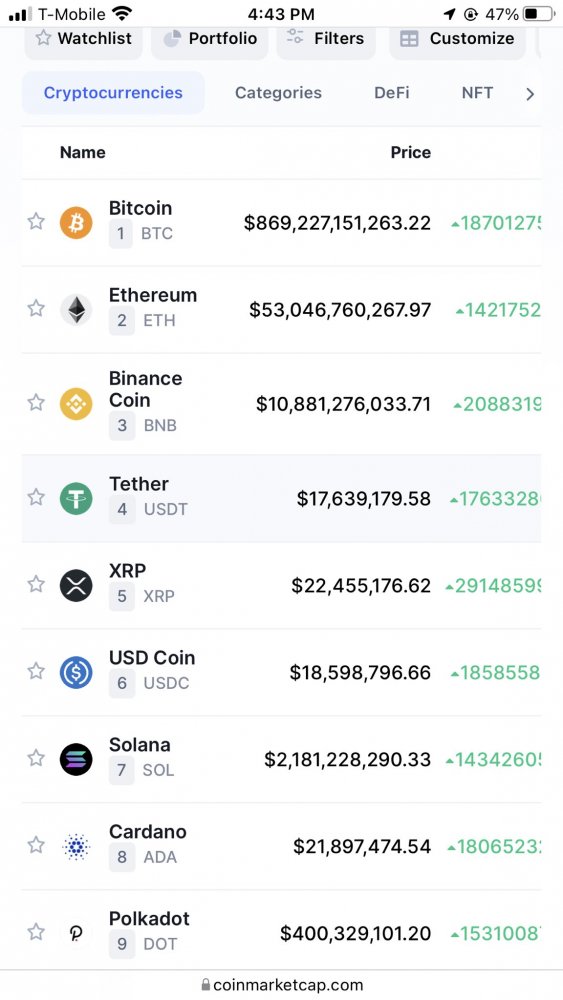

This one, taken by @BenScrivener, captures the top 9 cryptos by market cap listed on coinmarketcap.com.

At that moment, Bitcoin (BTC) was worth $869 billion, while Ethereum (ETH) skyrocketed at $53 billion, followed by Binance Coin (BNB) at nearly $11 billion and Tether (USDT) at over $17 million.

This screenshot shows XRP priced above the $22 million mark, but other shots shared on social media show that the price of XRP reached a high of $161 million.

As can be seen from the photo, the extraordinary and momentary gains were generalized to the whole cryptocurrency market.

The price glitch has bothered many retail investors who believed they would be able to sell their holdings and buy an island or two the next day.

The incorrect price data displayed by both Coinbase and Coinmarketcap has already been corrected and explained by the companies.

“We’re aware some customers are seeing inflated values for non-tradable crypto assets on Coinbase.com and Coinbase Wallet. This is a display issue only and does not impact trading”, said Coinbase Support on Twitter.

“The display issue has been resolved. Non-tradable assets on Coinbase.com are no longer appearing inflated, and assets on Coinbase Wallet should reflect the correct market value. Again, this did not impact trading […] Trades are processing normally, and we thank you for your patience.”

“Following the irregularities we observed on our platform this afternoon, despite the issue having been fixed, we will be rebooting our servers as a final step in accordance with our internal remediation plan. Apologies for the inconvenience”, said CoinMarketCap on Twitter.

Glitches in crypto

The cryptocurrency space has encountered other glitches in the past, namely Coinbase, which reportedly locked some customers out of their accounts in mid-November.

This particularly serious glitch kept some users from trading for weeks. They have recently launched a campaign demanding Coinbase to issue refunds for that glitch in the system.

Binance is handling arbitration proceedings from hundreds of users who were kept from making trades in May due to a technical glitch that locked them out of their accounts. Last month, the crypto exchange had an “issue with the latest doge wallet”, which prevented users from withdrawing DOGE.