Russia’s c-bank publishes new questions for FX market experts

FinanceFeeds’ editor Maria Nikolova tried to pass the test and spectacularly failed.

Ever since the Central Bank of Russia took control over the regulation of the Russian Forex industry, new requirements have been piling on the sector.

Today, Russia’s “Megaregulator” announced that it has changed the questions for the exams for attaining a certificate as a financial market expert. The changes affect the test for some FX dealer employees, who have to prove they are financial market specialists. The new questions are of various types, including ones that are more practically orientated, that is, you are presented with a particular case and then you have to offer a solution. There are also mathematical problems of different difficulty.

The new questions will be used in exams from April 1, 2017. Successful passing of such an exam gives you the right to hold higher positions in financial companies in Russia, including FX dealers – the official designation for companies offering Forex trading services in Russia.

- The Personal Challenge (and Failure)

FinanceFeeds’ Managing Editor Maria Nikolova spent several hours today trying to respond to the new questions outlined by Russia’s “Megaregulator”. Here is what happened.

The basic test (which is applied to experts of all the financial markets) did not seem that bad, although the question about capital calculation of a LTD company compared to a PLC gave me a hard time. There were also practical questions about how much should the net capital of a Forex dealer be, if the sum in the accounts of its clients exceeds RUB 150 million. The easy questions were those whose answers could be found in the Forex law, which was signed by president Vladimir Putin in the end of 2014. These questions concern maximum leverage, for instance.

It was the “First Series” test that made me sweat. “Who should sign the reports that the FX dealer files with the Bank of Russia?” is one of the questions that I could not answer.

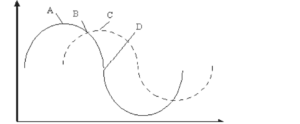

I made face expressions I’d thought I was not capable of while trying to decide “How many tech indicators is it best to use for market analysis?” or “There are more than 100 tech indicators. What does this mean?”. Then came the questions concerning the requirements for a company to be listed on LSE’s main market and about market-makers on NASDAQ, as well as a question to enumerate the instruments traded on Euronext. There were questions about MiFID 2, IOSCO, the CFTC and the Dodd-Frank act.

In summary, my test results are the following:

- Around 50% score on questions concerning the FX law itself and the main FX normative acts issued by Russia’s central bank.

- Approximately 35% score on the part concerning foreign regulation of financial markets.

- Only 10% score on the tech and fundamental analysis part.

Result: FAIL. Shame on me.