Saxo Bank adds FX expected trading ranges in Trade Signals in SaxoTraderGO

Knowing when an instrument is likely to be volatile or might consolidate can provide a firm and its clients a useful insight into the psychology and flow of the market.

More than five months have passed since online multi-asset trading and investment services provider Saxo Bank announced its partnership with AutoChartist that saw the integration of Autochartist’s tools into SaxoTraderGO. The Trade Signals service has since been gradually enhanced and enriched.

Saxo Bank has now added FX expected trading ranges in Trade Signals in SaxoTraderGO.

Understanding these ranges is important to both fundamental and technical traders, as they take them into account in their trading strategies.

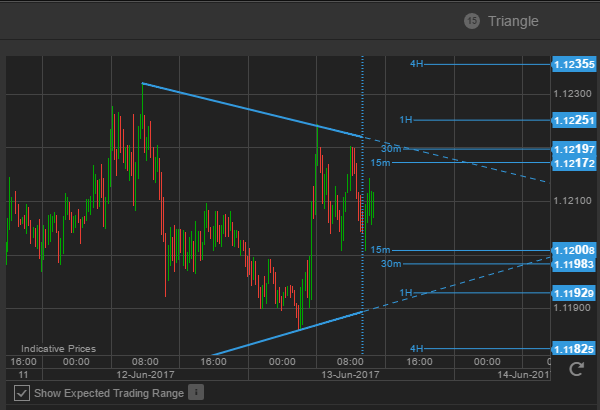

The Expected Trading Range is an analysis of the volatility of the instrument, providing a view of the expected price range movement for a given weekday and time of day based on average instrument price ranges over the past six months. The daily movement is a measurement of the high to low range, calculated over six months with the average movement for that day marked within the range for current market conditions.

Knowing when an instrument is likely to be volatile or might consolidate due to lack of participation can provide Saxo Bank partners and their clients an insight into the psychology and flow of the market. In particular, it can be useful for:

- setting appropriate market exit levels – Stop loss and Take profit placement should not only be place at strategic technical levels but should also take account of expected trade ranges for the period during which a position is expected to be held;

- knowing when to avoid trading instruments by detecting specific times of the day when the instrument’s price is expected to be volatile;

Expected Trading Ranges are integrated into Trade Signals in SaxoTraderGO and can be shown by checking the Show Expected Trading Range checkbox on a Trade Signal.

Expected Trading Ranges are shown for the Trade Signal period and for higher periods. The picture above offers an example of a Trade Signal showing the Expected Trading Ranges for the next 15m, 30m, 1h and 4h.

Saxo is also enhancing the products for its White Label partners via the launch of improved Performance Dashboards. Saxo is enhancing the functionalities of these dashboards through the addition of a customised Sales Funnel chart and a Client Segmentation chart. These views will be supported by a Sales Funnel Simulation tool distributed in an Excel format. The company is also planning to bolster the Demo Account Usage Statistics collected from partners’ leads. This information will be updated on a daily basis.