Saxo Bank enables white label partners to set up view-only users in SaxoTraderGO

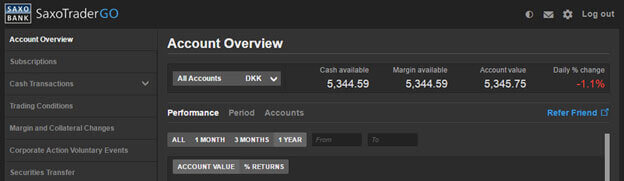

Saxo Bank’s partners can now set up non-trading clients with dedicated access profiles that allow access to the Account part of the platform only.

There is more news for the white label partners of online multi-asset trading and investment specialist Saxo Bank. Saxo Markets, the institutional division of Saxo Bank Group, has announced that its partners willing to set up non-trading clients now can do this by setting up view-only-users in SaxoTraderGO.

These users can get dedicated access profiles that will only provide them with access to the Account section of the platform which means they will not be allowed to place orders.

This can be quite useful when companies want to give access the platform to accountants or power of attorney clients. Such users can see reports and use other items from the account section.

The standalone section will be available for all partner login pages using “/account” after the normal login page (for instance, “www.saxotrader.com/account”). At present, the “/account” Login page is unbranded. However, by mid-June this page is set to get the same branding as the main SaxoTraderGO login page. One exception is the Live/Sim switch, which will not be available, as the /account Login page is not available for simulation.

Recently, Saxo Markets has unveiled another major change concerning white labels: the introduction of a new policy for white label clients’ proprietary trading.

The company attributed the changes to “increased complexity within reporting requirements”. Saxo is offering its white label partners a full separate structure for all proprietary trading requirements they might have in order to provide them with full transparency and to enable them to keep the activity of their client trading separate from any proprietary trading activity.

Saxo has a high number of white label partners that make use of the bank’s proven technology. In a research piece, published in October last year, Saxo Bank’s Søren Kyhl and Stig Tørnes explained the benefits of viewing banking as a platform (BaaP), a strategy which leaves the bank open to partnerships with other banks or fintech companies. Søren Kyhl and Stig Tørnes stressed the importance of banks applying a dual partnership strategy: engaging directly with customers through the bank’s customer interface as well as attracting flow or business from other partners, like banks or fintech companies, within their core areas.

SaxoTraderGO has itself undergone remarkable development since its launch in May 2015. The platform became available to Saxo’s white label partners in November 2015.

Amid the latest enhancements to SaxoTraderGO we should, of course, mention the integration of Autochartist’s tools into the platform early this year. The integration, as FinanceFeeds has noted, was timely, considering that retail traders now want all of the analysis tools and ancillary services on the same platform from which the execute trades.