Saxo Bank to exercise option for early redemption of Tier 2 CoCo capital notes

In accordance with the terms and conditions for the notes dated April 14, 2015, Saxo Bank A/S may redeem all of the outstanding notes before final maturity date.

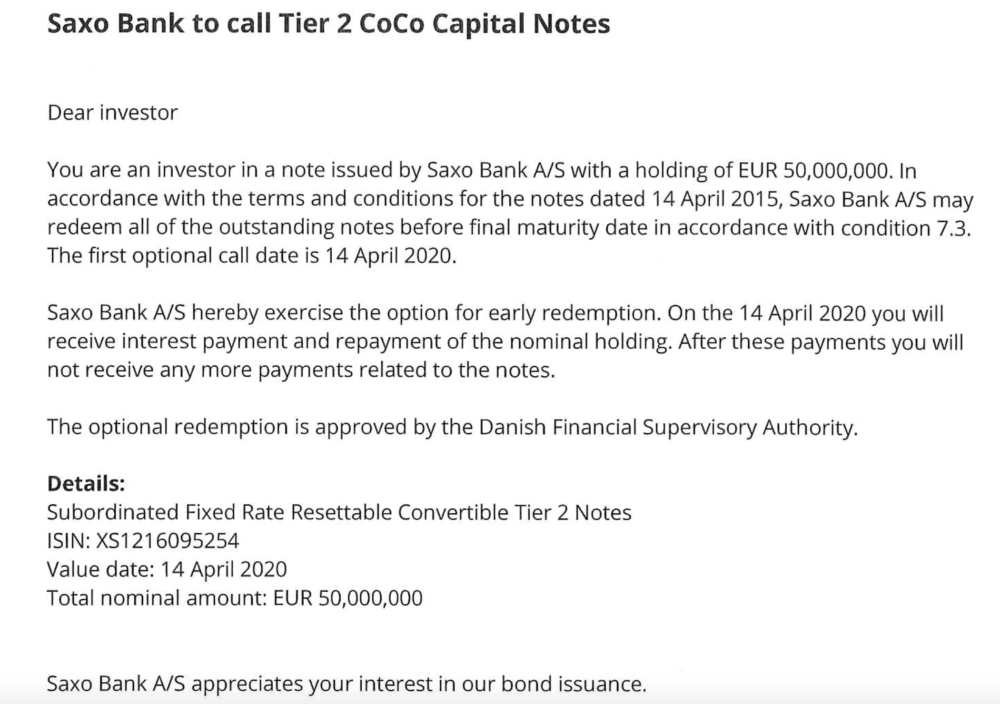

Multi-asset trading and fintech expert Saxo Bank today announces it will call Tier 2 CoCo Capital Notes.

Saxo Bank has issued a notice to exercise the option for early redemption of Tier 2 CoCo capital notes (ISIN: XS1216095254). This covers notes with a total nominal amount of EUR 50 million.

In accordance with the terms and conditions for the notes dated April 14, 2015, Saxo Bank A/S may redeem all of the outstanding notes before the final maturity date. The first optional call date is April 14, 2020. On this day, investors will receive interest payment and repayment of the nominal holding. After these payments investors will not receive any more payments related to the notes.

The optional redemption is approved by the Danish Financial Supervisory Authority.

In January 2020, as FinanceFeeds reported, Saxo issued a notice to investors regarding additional tier 1 (AT1) capital notes.

The notes were issued in November 2014. Back then, Saxo Bank announced that it had issued additional tier 1 capital under the CRD IV and CRR regulation. The issued amount was EUR 42.5 million (approx. DKK 317 million as per exchange rates of November 20, 2014). The earliest optional redemption date is February 26, 2020. Saxo Bank made use of the option for early redemption.