Saxo Bank to expand chart tools lineup in SaxoTraderGO

Linear Regression Lines is a new statistical chart annotation tool which is used to predict future values from past values.

Multi-asset trading and investment expert Saxo Bank is enhancing the charting functionalities of its SaxoTraderGO platform.

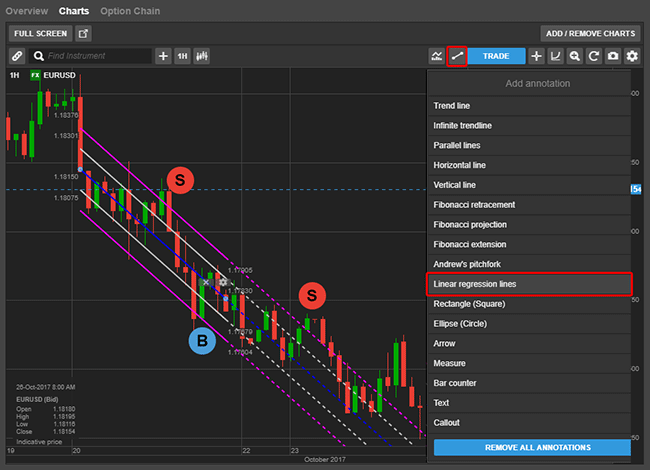

The company has announced that from November 4, 2017, Linear Regression Lines will be available in SaxoTraderGO. Linear Regression Lines represent a new statistical chart annotation tool which is used to predict future values from past values. In graphical terms, this is a straight line that best fits the prices between a starting price point and an ending price point.

A “best fit” means that a line is constructed where there is the least amount of space between the price points and the actual Linear Regression Line.

Traders use the Linear Regression Lines in order to determine a trend direction regarded as the fair value. If the price for an instrument is below a Linear Regression Line for some time, it could be an indication of a trend change and this could be considered a “buy” signal. And if the price is above the Linear Regression Line, it could be considered a “sell” signal.

As it can be difficult to identify how far below or above the line a price should move before it is a credible buy or sell signal, traders may need more objective indicators, so extra lines can be added parallel to the Linear Regression Channel. Saxo has added extra lines by default at ±1 and ±2 Standard Deviations. Traders can remove these outer lines in the configuration settings for the annotation.

An example of how a Linear Regression Channel is used on a EURUSD chart can be viewed below (the linear regression channel is shown as dashed lines).

While we are on the topic of improved user experience , let’s note that users that do not fancy crowded trading screens will soon be able to remove all annotations and studies on an instrument. A new Remove all Indicators button will be available from November 4, 2017 in the Indicator drop down menu which will remove all annotations and studies on the current instrument. Similarly, a Remove all studies is available in the Studies menu to remove all studies on the instrument (both overlay and sub-panels studies are removed).

This will also make it easier for traders to start a new analysis on the same instrument.