Saxo Bank October volumes show slight increase to $218 billion; stagnant compared to most of the year

A steady increment in activity for Saxo Bank during the month of October resulted in a total monthly trading volume of $218 billion, which is relatively on a par with last month’s $216 billion. Despite the slight increase, when looking at figures for the year as a whole thus far, October’s trading volumes remain considerbly […]

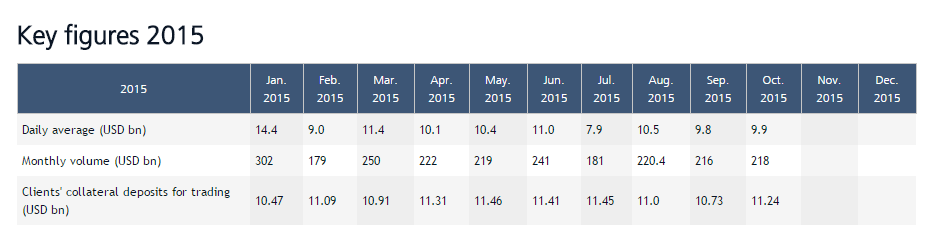

A steady increment in activity for Saxo Bank during the month of October resulted in a total monthly trading volume of $218 billion, which is relatively on a par with last month’s $216 billion.

Despite the slight increase, when looking at figures for the year as a whole thus far, October’s trading volumes remain considerbly below those achieved during most of 2015, with the exception of October, February and July.

Saxo Bank made a stellar start to 2015 with a volume in January of $302 billion, and despite the unprecedented market volatility experienced on January 15 when the Swiss National Bank removed the peg on the EURCHF pair, remained very solid.

February’s volumes were a shadow of those achieved in January, however as winter gave way to spring, trading activity increased before tailing off at the end of the summer.

Average daily volumes at Saxo Bank in November were $9.9 billion, similar to September’s $9.8 billion.