Saxo Bank promotes Thomas Jegu to lead French operations

Saxo Bank has today announced the promotion of Thomas Jegu, who replaces Pierre-Antoine Dusoulier as Head of Saxo Bank’s office in France.

Technologically advanced electronic trading company Saxo Bank has today announced the promotion of Thomas Jegu, who replaces Pierre-Antoine Dusoulier as Head of Saxo Bank’s office in France.

Mr. Jegu joined Saxo Bank in Paris in January 2008 as Head of Sales for France, a position that he held for four and a half yearss until he was promoted to Managing Director in May 2012.

Making a commercial statement today on Mr. Jegu’s promotion, Saxo Bank’s Global Head of Sales Matteo Cassina stated “Pierre-Antoine Dusoulier, Head of Saxo Banque France which he founded ten years ago, has decided to pursue new business opportunities. We thank Pierre-Antoine for his hard work and dedication throughout this period and wish him the very best for his future”

“Thomas Jegu, who has been with Saxo for more than 9 years, will take over the role as President of Saxo Banque France. Having served as Managing Director and daily leader of Saxo Banque France for several years, we are confident that Thomas is the right person to keep Saxo Banque France on its strong growth path and leverage our strong technology and product offering even further” – Matteo Cassina, Global Head of Sales, Saxo Bank.

Paris has long since been a very interesting location for Saxo Bank. In mid 2015, the company launched its device-neutral SaxoTraderGo platform, unveiling it for the very first time.

Mr. Jegu’s promotion accentuates Saxo Bank’s ethos of engendering executives from within the company to progress, reinforcing the quality aspect of the firm’s product.

Graduating from Idrac Lyon in 2005, Mr. Jegu became Sales Trader and Team Leader at Cambiste, which preceded his 9 year tenure at Saxo Bank in Paris.

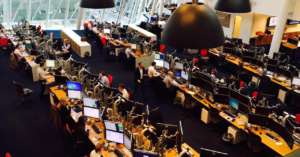

Featured Image: Saxo Bank headquarters, Hellerup, Denmark. Copyright FinanceFeeds