Saxo Bank responds to increased interest in Bitcoin

Saxo clients get exposure to Bitcoin thanks to two new Exchange Traded Notes tracking the movement of Bitcoin against the US Dollar.

Saxo Markets, the institutional division of Denmark-based multi-asset trading and investment expert Saxo Bank, has informed the company introducing brokers that their clients can now get exposure to Bitcoin.

Saxo Bank notes that the interest in cryptocurrencies has risen significantly in 2017 thanks in large part to the increased supply and demand in China and Japan. As a result, traders have increasingly yearned for a product which enables them to speculate on the price of Bitcoin, the most well-known cryptocurrency.

In response to this growing interest, Saxo has added two new Exchange Traded Notes (ETNs) to its offering. Saxo clients can now get exposure to Bitcoin through these two new ETNs designed to track the movement of Bitcoin against the US Dollar (BTC/USD).

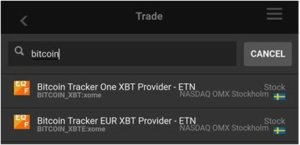

‘Bitcoin Tracker One’ is traded in Swedish krona (SEK) and ‘Bitcoin Tracker EURO’ is traded in Euro (EUR). Both ETNs are issued by XBT Provider AB and traded on Nasdaq OMX (Stockholm).

If Saxo’s partners are subscribed to these exchanges, the Bitcoin trackers will be enabled automatically on their platform. The easiest way to find the new instruments is by searching for “bitcoin” in the trading platform. The ETNs will appear in the search result list.

Lately, a growing number of online trading companies have sought to satisfy the demand for virtual currency products. In July this year, Swissquote, the leading online bank in Switzerland, launched Bitcoin trading on its trading platform. Customers invest in Bitcoins against the Euro or the US Dollar through their trading accounts, just as they would with any other currency, except without access to leverage. For this project, Swissquote has partnered with Luxembourg-based Bitstamp, a company specialized in Bitcoin trading since 2011.

Another online trading firm that has been expanding its cryptocurrencies offering is IG Group. Earlier this summer, IG has launched trading on Ether, the token of the Ethereum network. This development enables traders to take a position on whether the value of the cryptocurrency will rise or fall, without having to take the risks associated with buying and storing it.