Schwab posts net income of $671m in Q2 2020

The company has made significant progress on its pending acquisition of TD Ameritrade, with the completion of the Department of Justice antitrust review and affirmative votes by both Schwab and TD Ameritrade stockholders.

The Charles Schwab Corporation today posted its financial metrics for the second quarter of 2020.

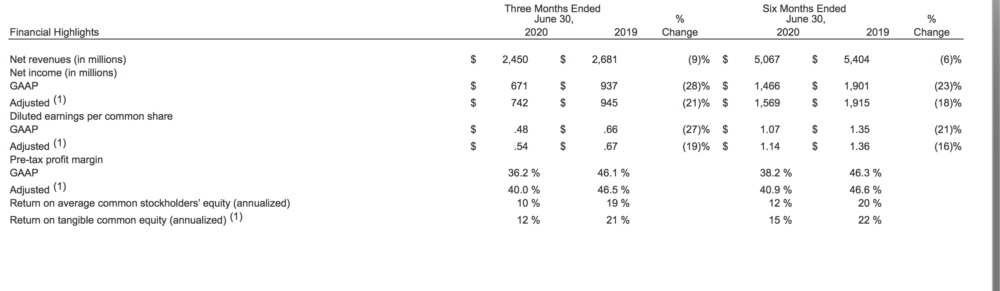

Net income for the second quarter of 2020 was $671 million compared with $795 million for the first quarter of 2020, and $937 million for the second quarter of 2019. Net income for the six months ended June 30, 2020 was $1.5 billion, compared with $1.9 billion for the year-earlier period. The company’s financial results for both the second quarter and first half of 2020 include certain acquisition and integration-related costs as well as the amortization of acquired intangibles, which together totaled $93 million and $136 million, respectively, on a pre-tax basis.

CEO Walt Bettinger noted Schwab’s recent M&A activity:

“Recent weeks have included a string of M&A milestones for our firm, each representing another step on our path of building a more capable Schwab. In addition to closing the USAA and Motif transactions, we also brought Wasmer Schroeder in-house, adding a leading investment manager of fixed income separate accounts to Schwab’s advisory line-up.

He commented on the progress of the deal with TD Ameritrade:

“Moreover, we made significant progress on our pending acquisition of TD Ameritrade, with the completion of the Department of Justice antitrust review and affirmative votes by both Schwab and TD Ameritrade stockholders. Our teams are working diligently on integration planning efforts and we remain on track for closing during the second half of this year. Pulling off four acquisitions in close succession, concurrent with sustained progress on our other initiatives to build scale and efficiency, further diversify our revenues, and enhance our product and service capabilities across client segments, would be challenging enough under the most favorable conditions”.

CFO Peter Crawford noted that trading volumes remained elevated in the second quarter compared with a year ago. However, the impact of Schwab’s October 2019 pricing actions still led to a 7% year-over-year decline in trading revenue to $193 million. Overall, total revenues contracted 9% from a year earlier to $2.5 billion, while reported expenses rose 8% to $1.6 billion.

Overall, Schwab produced a 36.2% pre-tax profit margin (40.0% on an adjusted basis) and 10% return on equity (12% ROTCE).