Hong Kong share CFDs will be commission-free for a limited period of time.

Search Query: #cfd

The DXtrade platform features built-in trading journals, performance dashboards, responsive charting, and mobile trading apps.

FX, Fintech and cryptocurrency markets have been bustling with activity over the past week, as is often the case. Keep yourself informed and ahead of the curve with a curated selection of crucial stories and developments that are most relevant to those engaged in the markets.

Interactive Brokers has expanded its suite of investment options for Japanese clients with the addition of CFDs on US stocks.

“With all the products that are in our roadmap for this year, doubling the current number of clients is just a matter of time. In 2024, as we plan to add bonds, retirement products and an e-wallet with a multi-currency card, we plan to welcome 65-90k new clients per quarter.”

“Partnering with TradingView represents a pivotal moment in our quest to bring low-cost trading to traders everywhere. Being the lowest cost broker on such a prestigious platform underscores our unwavering commitment to providing exceptional service at the lowest costs. With TradingView’s array of features and our radically low costs, we truly believe there is no better trading experience available…and we’re only getting better.”

FinanceFeeds spoke with Andrew Saks of TraderEvolution Global, Iouri Saroukhanov from Cboe Europe, Remonda Kirketerp-Møller of Muinmos, and Quinn Perrott of TRAction, to ascertain their perspectives on the evolving regulatory environment in Europe, specifically how it’s shaping the transition from CFDs to listed derivatives and what it means for the future of trading and brokerage services in the region.

Italy’s financial markets watchdog has raised an alarm regarding a surge in unregulated investment platforms in their jurisdiction, urging individuals to remain vigilant and exercise caution while engaging in financial transactions.

“Within the hard numbers of ultimate performance, the approach to relationships and teamwork has been an influential factor behind the motivation of this partnership. INFINOX values partnerships and relationships above all else, a similar culture held at Alpine Motorsports.”

In its latest episode, the FinanceFeeds Podcast unveils a riveting conversation with Igor Galkin, co-founder of Companionville Recruiting, which addresses the FX and CFD industry’s talent acquisition needs with an innovative approach: performance-based recruitment and preferred ghost shares.

“At Vantage, our commitment to excellence has been unwavering. The expansion of our CFD products offering on indices reinforces our dedication to providing traders with a reliable and comprehensive trading experience that sets us apart from the competition.”

Examining the product landscape, the OTC EQD market encompasses a range of instruments, including swaps, forwards, options, contracts for difference, and other products. A noteworthy trend highlighted in the paper is the growth of equity forwards and swaps in comparison to OTC equity options.

The brokerage firm offers access to self-directed trading via MetaTrader 5, as well as PAMM accounts and a Copy Trading service. The CFD offering includes a multi asset exposure to the financial markets with up to 1:400 leverage. Underlying asset classes include FX, indices, bonds, commodities, crypto, ETFs, and shares.

Join us as we delve into Jonathan Baumgart’s profound insights from the FinanceFeeds Podcast. The CEO of Atomiq Consulting discusses critical industry trends, the intricacies of brokerage licensing, and the evolving landscape of forex trading.

“The addition of these 19 new ETF CFDs to the TickTrader platform, reflects our dedication to meeting the evolving needs of our traders, allowing them to access a broader spectrum of trading opportunities, catering to diverse trading preferences and strategies. We believe that this expansion will only serve to enhance the trading experience our clients have at FXOpen.”

China stands as a global economic powerhouse, boasting a dynamic and diversified capital markets system that spans across various industries. The country’s economic vibrancy, coupled with its modern outlook and futuristic advancements, continues to attract investors worldwide. In the first quarter of 2023 alone, China recorded a remarkable national GDP of $14.8 trillion, showcasing a robust year-on-year growth of 5.2%.

In the dynamic realm of retail electronic financial markets, opportunities abound as new and significant instruments emerge regularly. FXOpen, committed to expanding the range of accessible tradable assets, has recently introduced 19 exchange-traded funds (ETFs) as Contracts for Difference (CFDs).

The expansion of FP Markets’ Commodity CFDs offering, particularly in hard commodities like Lead (XPB/USD), Zinc (XZN/USD), Nickel (XNI/USD), Aluminium (XAL/USD), and Copper (XCU/USD), as well as the addition of more counterparts to Spot Gold (XAU) like GBP, SGD, and CNH, is highly beneficial for a global trading clientele, especially in the current environment characterized by geopolitical uncertainty, market volatility, and high-interest.

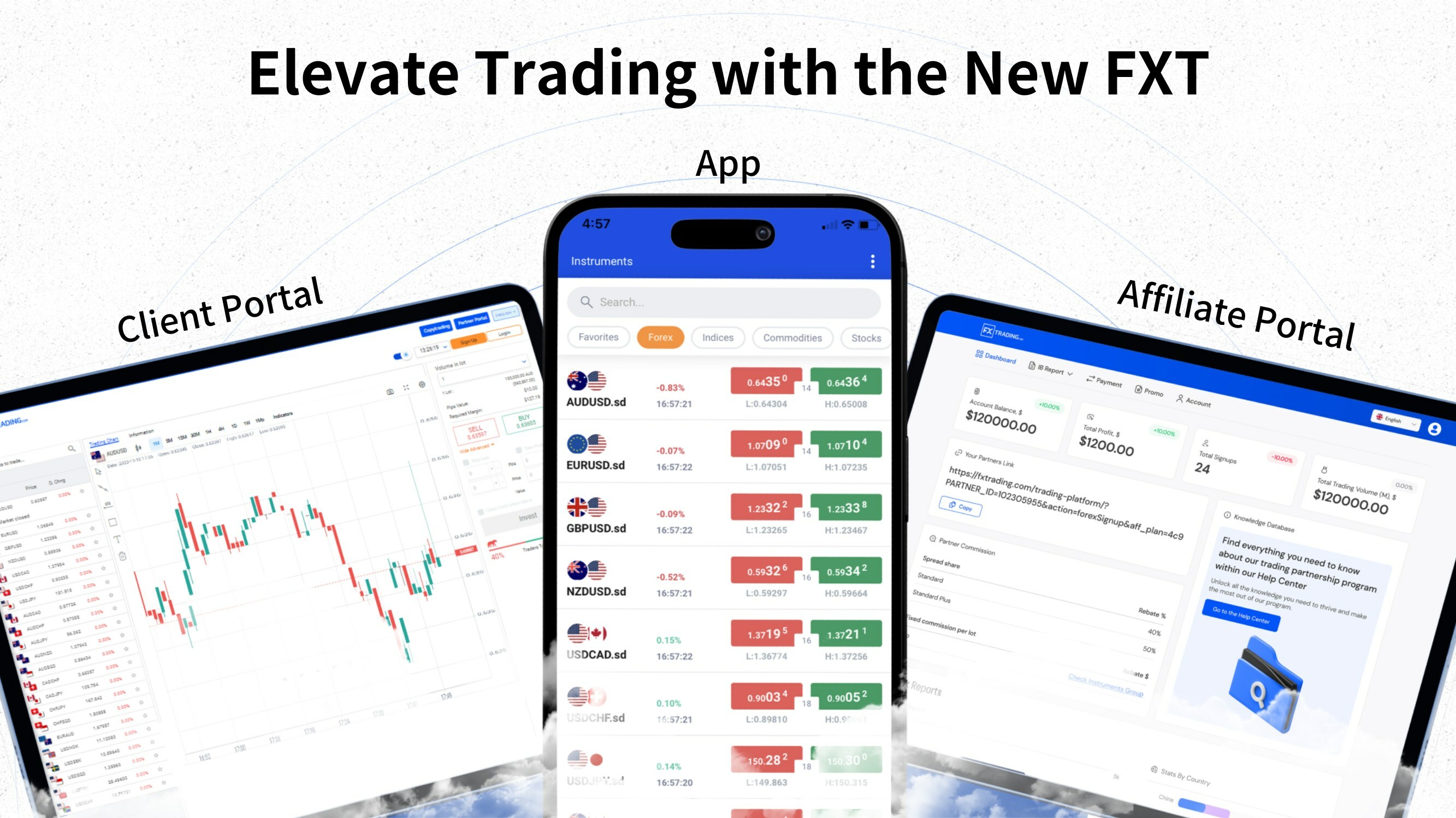

FXTRADING.com, a Sydney-based forex broker and part of the Gleneagle Group, has launched an innovative trading ecosystem – FXT. This platform is a comprehensive suite of trading solutions, revolutionizing the trading experience for both traders and affiliates.