Libertex has announced the expansion of its Crypto CFD offering by adding Arbitrum, the layer-2 scaling solution for Ethereum that runs its own blockchain.

Search Query: #crypto cfd

Crypto CFDs require no physical settlement and will still allow clients to enjoy 24/7 liquidity and positions marked-to-market daily, with prices streamed in numerous fiat base currencies including USD, EUR, GBP, JPY, and more.

London-based trading technology provider BidX Markets has added over 120 Crypto CFDs to its product portfolio catering to professional traders and brokerages.

Equiti Brokerage, the Seychelles-based subsidiary of multi-asset trading services provider Equiti Group, has expanded its cryptocurrency CFD offering.

London-headquartered INFINOX has expanded its service offering by incorporating 22 new crypto CFD products on its platform.

Orbex is adding crypto to a wide range of trading products available to users, including forex, equities, indices, metals, energies, and futures.

RADEX MARKETS operates outside ASIC’s scope, which allows users to enjoy leverage of up to 500:1, which is banned in Australia since late March 2021.

Sydney-based IC Markets, an online provider of FX services and ECN trading capabilities, has once again strengthened its offering, this time adding five new cryptocurrencies to its growing suite.

ThinkMarkets has expanded its range of cryptocurrency instruments and will now add trading support for additional coins, which join its already installed CFDs on digital assets.

“We can see that there’s been such a shift towards including cryptocurrency trading as more and more traders use the products as safe haven assets.”

FinanceFeeds sat down with Libertex Group Chief Marketing Officer, Marios Chailis to discuss the recent dovish price movement in crypto-assets and how traders can potentially take advantage of such fluctuations to find opportunities with cryptocurrency CFD products.

“Deliverable crypto is a different matter. When crypto exchanges start being regulated and offering reliable connectivity, brokers still have to make sure that their aggregation software is able to handle cryptos and their infrastructure can ensure timely delivery. Moreover, counterparty risk remains much higher than with a regular forex LP”, said Ms. Zakharova.

In the follow-up of Bybit’s UK operation shut down amid the ban on crypto CFDs, the cryptocurrency derivatives exchange has appointed Daniel Lim as general counsel.

IG Group was required to take measures by the UK financial watchdog after the FCA issued a ban on the sale of derivatives and exchange traded notes (ETNs) that reference certain types of cryptoassets to retail consumers.

Our partnership with B2C2 is an exciting development given that demand for cryptocurrency CFD trading is unprecedented and continues to grow unabated. B2C2 is a high quality cryptocurrency CFD provider and we are delighted to be working in partnership with them.” – Tom Higgins, CEO, Gold-i

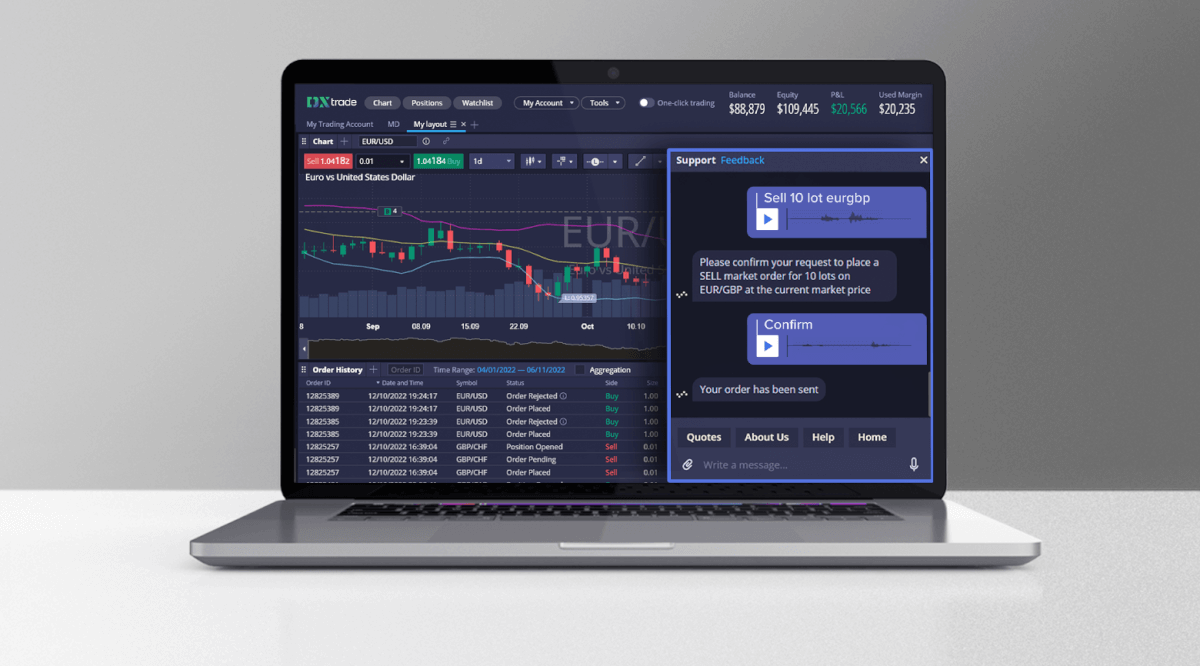

Devexperts aimed to create a truly turnkey experience for brokers licensing the DXtrade CFD and DXtrade Crypto platforms. These platforms cater to FX, CFD, and crypto brokers, providing them with seamless integration and enabling a quick launch by offering all the necessary integrated components.

“With her proven track record in liquidity management and a deep understanding of the Forex, CFD and crypto markets, we are confident that Elizabeth will play a pivotal role in expanding our market presence and deliver exceptional results for our international and quickly expanding client base.”

“Adding a crypto-native platform to our technology offering is particularly significant and puts us at the forefront of the industry in terms of our technology offering. In fact, we believe XplorSpot is one of the first crypto native platforms, specifically developed for institutional trading.”

“Other live chat solutions simply aren’t able to provide a native experience on a web platform—they’re plagued by UI issues. Meanwhile, DXtrade brokers and traders enjoy a superior experience even when sharing a screen. That’s why our combo has no true market peers”.