SEC targets binary options marketer who caused 25,000 investors to make deposits with unregistered firms

The misleading websites and videos were viewed by more than 350,000 persons and caused more than 25,000 investors to make deposits for trading binary options with one of approximately 35 unregistered brokers.

The United States Securities and Exchange Commission (SEC) continues to target binary options scams as exhibited by the latest action launched by the regulator at the Massachusetts District Court earlier this week.

The SEC’s complaint, filed with the Court on September 27, 2019, and seen by FinanceFeeds, targets Peter Szatmari. From at least January 2014 through December 2016, Szatmari and his marketing partner David Sechovicz created and/or disseminated false and misleading Internet-based promotional materials designed to drive viewers of binary options brokers’ websites and induce them to open and fund binary option trading accounts. The Commission has filed separately an action against David Sechovicz. He and the SEC have agreed, however, to immediately resolve that action and therefore the claims against Sechovicz.

Szatmari and Sechovicz worked as “affiliate marketers.” Binary options brokers paid the duo a pre-set commission (typically $350 to $450) for each investor who opened and funded an account with those brokers as a result of viewing fraudulent marketing materials that Szatmari and his partner created and/or disseminated.

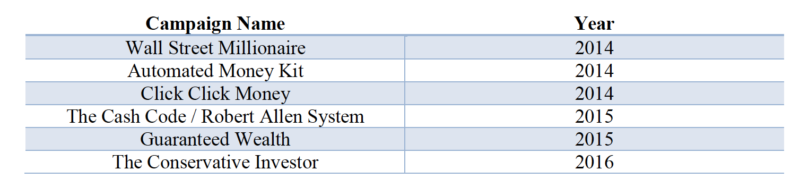

Between 2014 and 2016, Szatmari participated in the creation and dissemination of at least six false and misleading marketing campaigns designed to persuade potential investors, predominately in the United States, to open and fund binary options trading accounts with overseas unregistered brokers operating on the Internet. These campaigns’ advertising materials generally consisted of (a) textual materials disseminated over the Internet; (b) a website; and (c) one or more videos embedded into the website.

The six binary options affiliate marketing campaigns in which Szatmari was involved are:

The misleading websites and videos were viewed by more than 350,000 persons and caused more than 25,000 investors to make deposits for trading binary options with one of approximately 35 unregistered brokers. These unregistered brokers offered and sold binary options referencing securities over the Internet to investors in the United States.

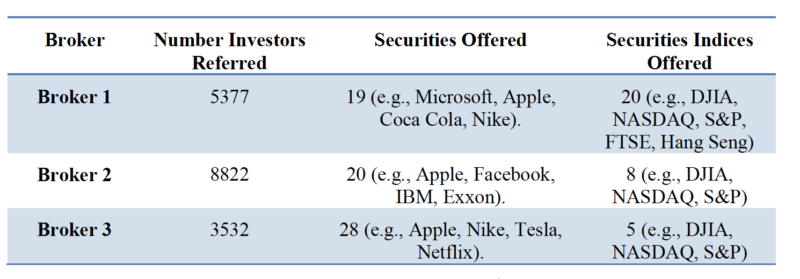

The table below displays the securities and securities indices offered and sold by three brokers, representing approximately two-thirds of the referrals Szatmari helped make during the relevant period.

The SEC says that Szatmari was aware the statements in the campaigns were untrue. In one January 2014 email, says:

“Currently we get people excited about a software and then don’t give them anything and tell them it’s included with their broker… So let’s take a step back and look at what this software represents. It’s the traders [sic] imaginary secret friend giving him the tips on what to trade and actually doing it. The trader does not want to think about what trades to make – he wants something else to make that decision for him. This something – as we told him – will pick the winning trades for him (and potentially even make it for them)… Essentially we’re talking about lazy and greedy person who expects and believes that some magic push button software will make lots of money for them – without having to make a decision AND act on the decision… We certainly get plenty of people who are not bothered by the fact that there is no software”.

In June 2016, Szatmari wrote Sechovicz:

“Something Yoni [a broker] mentioned has struck me. Namely that their customers just want a friend, someone to talk to, to act like their psychiatrist. And their customers are basically ‘paying’ for that – with all their trading losses …”

Szatmari and Sechovicz realized approximately $3.8 million in profits from the six campaigns launched between 2014 and 2016. They also disseminated false and misleading binary marketing campaigns create by other affiliate marketers. The duo realized approximately $1.66 million in additional profits through remarketing.

The SEC seeks civil monetary penalties and remedial ancillary relief, including, but not limited to, disgorgement of ill-gotten gains, injunctions, and such other relief as the Court may deem necessary and appropriate.