SEC v. Ripple: What’s next in the XRP lawsuit?

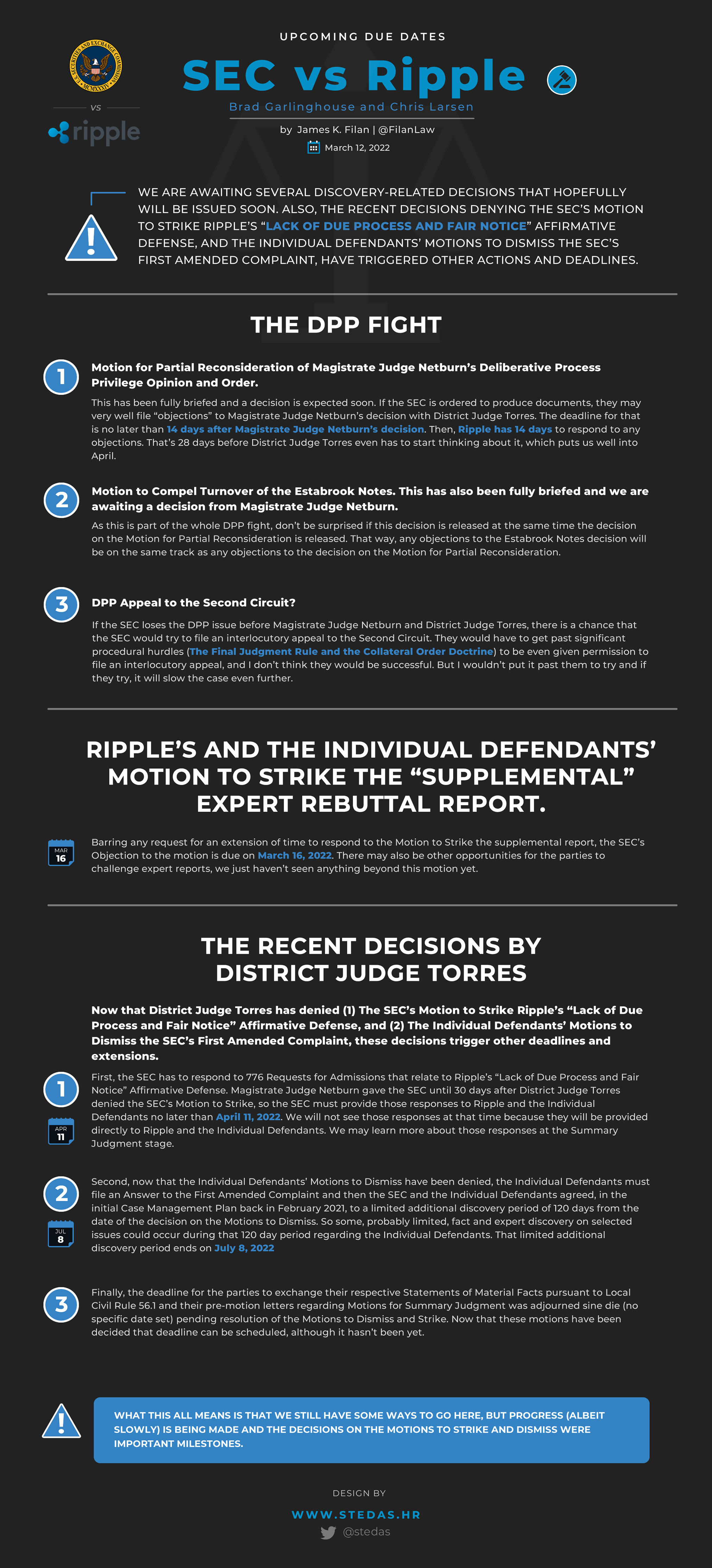

James K. Filan, a Connecticut-based attorney specializing in securities litigation and regulatory compliance, has shared a timeline with the upcoming due dates in the SEC v. Ripple lawsuit.

The SEC v. Ripple remains one of the most high-profile lawsuits for the financial services industry in the United States and in the world as the outcome of the precedent-setting case is likely to ripple through the space as firms and the SEC take notes on how to approach digital assets.

Many have said it is all about the Fair Notice because of its potential to strike a blow to the SEC’s regulation-by-enforcement practice. Judge Analisa Torres has recently denied the SEC’s motion to strike the fair notice defense and explained how Ripple could win using that defense.

In the meantime, the SEC has found a new way to tackle the DPP issue: the plaintiff is using Judge Torres’ recent ruling to argue that the privileged documents, including Hinman’s notes and emails and the Estabrook notes, are irrelevant in the lawsuit.

The abovementioned ruling was the individual defendants’ motion to dismiss the case against them, which the judge denied. Also worth of note was her statement that XRP sales were not predominately foreign, thus rejecting Garlinghouse and Larsen’s claim.

In a recent interview with Joseph Grundfest, the ex-SEC official said the SEC would face a big challenge with the complexities of the XRP structure in order to detect transactions that are, in fact, inside the SEC’s jurisdiction. By stating that XRP sales were not predominately foreign, the court might believe there is no such issue.

The deliberative process privilege (DPP) stands in the way

James K. Filan, a Connecticut-based attorney specializing in securities litigation and regulatory compliance, has shared a timeline with the upcoming due dates in the SEC v. Ripple lawsuit.

While the critical DPP fight is still ongoing, the lawyer stated the court’s decisions on the motions to strike the fair notice defense (denied) and to dismiss the court against the individual defendants (denied) were milestones.

The image was designed by XRP community member @stedas, using attorney Filan’s lawsuit agenda.