How setting up a Bermuda subsidiary was good for FXCM

Setting up unregulated subsidiary FXCM Markets may turn out to be one of the smartest moves for FXCM.

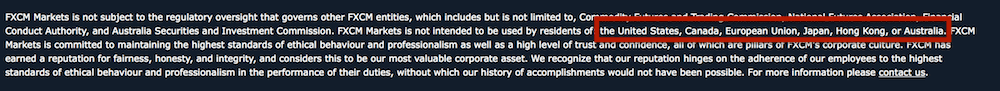

When in April 2013, media sources reported that retail Forex major FXCM had set up an unregulated business based in Bermuda, the move raised eyebrows. Why would a company present in such jurisdictions like the United States, Australia and the European Union (led by the UK business of FXCM – Forex Capital Markets Limited), opt for such a peculiar sort of expansion? The answer provided back then was simple – the broker was seeking to target more markets, offering trading perks like leverage of up to 400:1.

Back in the days, the lack of regulation was the obvious disadvantage of FXCM Markets, whereas the solid reputation of FXCM was a serious advantage.

The current situation has changed dramatically and the revamped (and much bearer) website fxcm.com mentions FXCM Markets and the fact that it is unregulated right after noting the existence of FXCM UK and FXCM Australia. Furthermore, those visitors of the website who want to “Join FXCM Traders around the world” but are from destinations like the United States or Singapore, are currently redirected to FXCM Markets website.

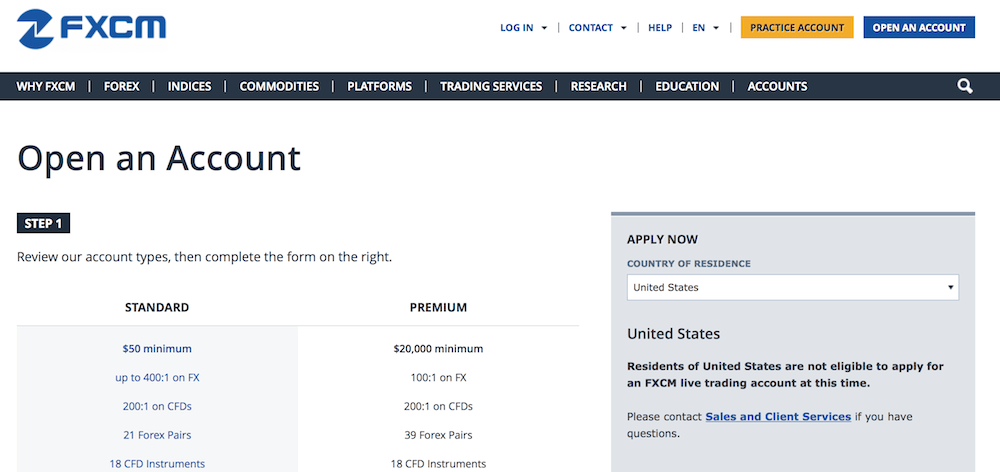

Let’s make this clear – FXCM Markets does not service US clients. Any attempt by a US resident to open an account, be it live or practice, via FXCM Markets will be unsuccessful.

This is in line with US regulations. Under the Commodity Exchange Act (CEA) and US CFTC regulations, since October 18, 2010, an entity that solicits or accepts orders from US customers in connection with forex transactions must register with the CFTC and comply with rules and regulations, including (inter alia) minimum capital requirements and record-keeping. Putting it bluntly, even an overseas company that wishes to target US residents should have the necessary registration with US regulators.

The CFTC has already demonstrated how it can punish violators of this rule. For instance, in February 2013, the CFTC filed a complaint in Court against Halifax Investment Services of Sydney, Australia for soliciting and accepting FX orders from US customers without registering with the CFTC as required.

Obviously, FXCM Markets is not offering any account opening to US customers. It is simply providing information about its services.

What matters here is how the tables have turned. Now it is FXCM tarnished reputation due to US regulatory actions that is the disadvantage of FXCM Markets. The lack of regulation has now become the most serious advantage of this business.

FXCM Markets is not affected by US regulatory measures that have prompted the US market exit of Forex Capital Markets LLC. In addition, should regulators in other jurisdictions follow suit and also punish the broker, FXCM Markets should remain unaffected. And that could mean the difference between an end of a business and its survival.