Share of female senior managers in UK financial services sector lowest at institutional brokerages – study

The share of female senior managers is highest for investment management institutions and lowest for institutional brokerages, according to an FCA research note.

The UK Financial Conduct Authority (FCA) has earlier today posted “Gender diversity in UK financial services”, a piece of research authored by Karen Croxson, Daniel Mittendorf, Cherryl Ng, and Helena Robertson.

The research draws on a unique FCA regulatory dataset to analyses gender diversity at senior levels in UK financial services, looking at role, firm and sector and how these have changed over time.

Diversity has remained consistently low at industry level (approximately 17%), notwithstanding some variation by role seniority, firm size and sector.

Generally, the researchers find greater gender diversity in firms that are larger and less in customer-dealing roles.

For a sample of 94 major institutions the typical share of female senior managers has grown relatively rapidly since 2005 (by 9pp), but only from a low base (9%), bringing them as a group in line with the still low industry average. There is wide variation across individual firms in the sample, with gender diversity of senior management ranging from less than 5 to over 40%.

Large investment management institutions have more gender diverse senior management; by contrast the sample suggests institutional brokerage is the least gender diverse subsector.

The research draws on data on individuals that held approval for FCA-regulated functions (‘approved individuals’) within the UK financial services industry between 2005 and 2019.

For a sample of major institutions, the percentage of female senior managers varies significantly (around 3 to 40%). This is despite an average growth of 9 percentage points in female representation at these firms since 2005.

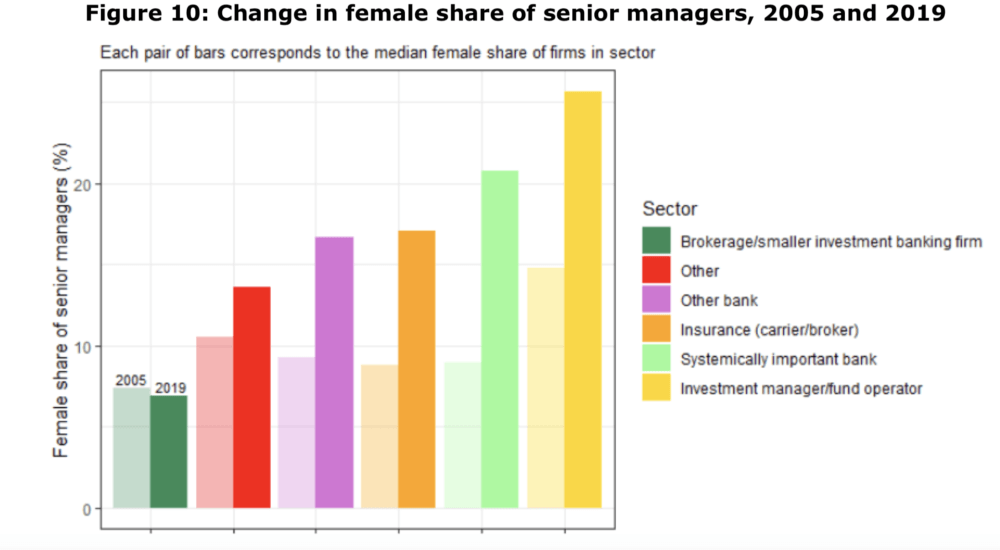

The share of female senior managers is highest for investment management institutions and lowest for institutional brokerages in the sample. Between 2005 and 2019, this share rose most for systematically important banks and least for brokerages.

The researchers find that across financial services, women make up just 17% of approved individuals. This share is relatively unchanged since 2005, despite significant fluctuations in the number of approved individuals.

The female share is higher (23%) among approved individuals associated with dual-regulated firms, compared to solo-regulated firms.

Looking at the subsample of 94 major institutions and groups in 2005, these were markedly less gender diverse at senior management level than the industry average. More than 3 in 4 had less than 15% of senior roles filled by women, and a quarter had even less than 7%.

Since then, the researchers find, the median female share of senior managers has grown from 9 in 2005 to 18% in 2019. This implies that more than half of the major institutions in the sample now have a female share above the industry average.

For the 14 large institutions the researchers label as investment managers, women typically make up around 26% of senior managers. In contrast, at 10 institutions classified as institutional brokerages and smaller investment banks women typically account for just over 5% of senior managers. None of the 10 brokerages had a proportion above 16%.

As the chart below shows, brokerage institutions constitute the only illustrative sector that has seen no rise in the median share of female senior managers between 2005 and 2019. All other sample sectors have seen the median gender diversity increase over this time period, especially the group of institutions in the systemically important bank category.