A short squeeze wasn’t the whole story behind GameStop’s stock spike

After months of speculation, a highly anticipated report issued last week by the top US regulator debunked most of the conspiracy theories that have swirled around the meme stocks’ frenzied trading early this year.

Overall, the US Securities and Exchange Commission’s release only outlined the events surrounding the most remarkable periods of the Covid-19 economy, but didn’t directly recommend any specific changes.

Since January, the SEC has been parsing the activity to uncover market instability and see if there was deliberate manipulation or fraudulent intent more broadly on stock markets.

These speculations were heightened after the SEC’s chief suggested structural changes to the way the equities market works. The report, however, didn’t add much momentum to Gensler’s push to toughen regulation since it had little indication of what actions the regulator might take.

While the 44-page document didn’t contain policy recommendations, the SEC staff investigated restrictions introduced by stock apps and online platforms, which sparked allegations involving conspiracy theories, political intervention, and that the hedge funds influenced trading platforms to stop the rout.

So, what happened?

The report acknowledges that in addition to retail investors’ activity, there was significant participation by institutional investors, including quantitative and high-frequency hedge funds. It also identified investors buying the stock to participate in the short squeeze as a catalyst behind the sudden rise in price, thus corresponding to “the beginning of the most dramatic phase of the run-up in GME’s price.”

Furthermore, the meteoric rise in the share price forced Wall Street institutions and other short betters to buy back the stocks at a higher price, effectively adding further upward price pressure and forcing other short sellers to join the race.

But according to the SEC’s document, such a short squeeze – while contributing to GameStop’s stock price spike – was not the whole story. Even during the biggest price spikes, investors closing out their short positions were a small fraction of overall buy demand, meaning that actual buyers with bullish views were driving the bulk of the bull run.

“Whether driven by a desire to squeeze short sellers and thus to profit from the resultant rise in price, or by belief in the fundamentals of GameStop, it was the positive sentiment, not the buying-to-cover, that sustained the weeks-long price appreciation of GameStop stock,” the SEC further states.

To support their point of view, the agency officials noted that GME share price maintained its upward trajectory even after the direct effects of covering short positions waned.

Interest in GameStop emerged two years ago

Other highlights show that retail investors’ discussions surrounding GameStop had actually been circulating since 2019. But it only peaked in January 2021, promoted by retail investors’ groups on Reddit’s boards and other social media networks.

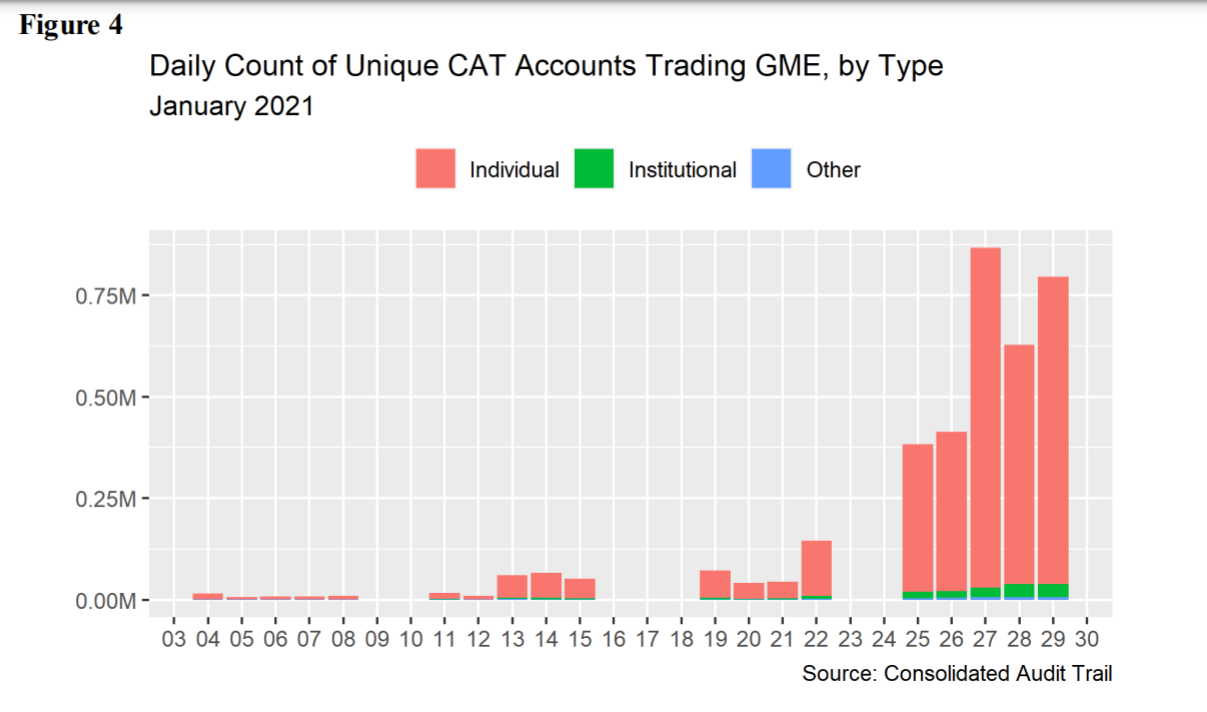

While it was believed that price swings in the meme stock were due to hedge funds covering their shorts, the vast majority of these accounts belonged to individuals.

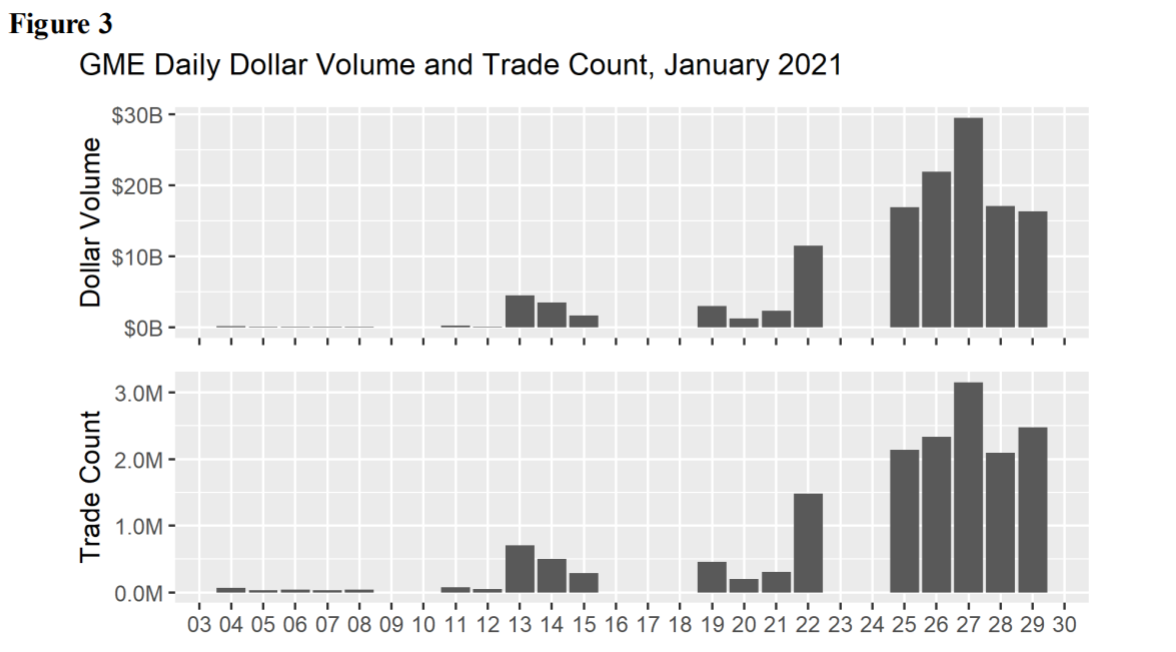

For context, the SEC points out that around 10,000 accounts were trading GameStop stocks at the start of January. This number had skyrocketed to nearly 900,000 on a given day by the end of the month. During this period, the video game retailer’s stock price soared 2,700% in the space of around 20 days, namely between its monthly low of $20.65 and its highest point at $483 per share.

What else was going on?

In addition, the US securities regulator said it found no evidence of the so-called “gamma squeeze,” which is caused by the influx of call option purchases by market makers to hedge their exposure, driving up the stock price in the process. This is also triggered by the “naked short selling,” where investors short sell shares that have not been affirmatively determined to exist.

“GME did not experience persistent fails to deliver at the individual clearing member level. Specifically, staff observed that most clearing members were able to clear any fails relatively quickly, i.e., within a few days, and for the most part did not experience fails across multiple days,” the SEC further explains.

Nevertheless, the regulator said that the price surge in GME – while mainly caused by retail investors banding together on Reddit – also raises questions of market efficiency that relate to short selling.

“While a short squeeze did not appear to be the main driver of events, and a gamma squeeze less likely, the episode highlights the role and potential impact of short selling and short covering,” the agency said.

Short selling – which allows investors to make gains in a falling market by borrowing a security they don’t own, selling it and agreeing to buy it back at a lower price – plays a vital role in developed capital markets since it makes price discovery more efficient while providing investors with a host of risk-management tools.

However, US regulators require brokers to deliver the shares after completion of their clients’ short transactions on the settlement date or take action to close out the “failure to deliver” shares by purchasing or borrowing the securities. To limit ongoing naked short positions, the broker has no choice but to reject any additional sale orders if the securities were not delivered or closed out within required time frames.

Summing up

Another major topic addressed in the SEC report was whether hedge funds pushed retail brokers like Robinhood to restrict customers from trading in red-hot GameStop stock as it was surging.

Robinhood CEO denied before a House committee speculation that he was pressured by hedge funds to halt the meme stock craze. In a testimony, Tenev explained that Robinhood limited trading to meet its financial obligations after clearing houses hiked deposit requirements for equities ten-fold. This situation forced his company to raise $1 billion in emergency funds from investors to meet clearinghouse deposit requirements aimed at preserving their net capital positions.

However, Robinhood critics claim its business model has an inherent conflict because the startup generates revenue by selling customers’ orders to hedge funds and other trading firms.

Finally, the SEC said the GameStop incident provided an opportunity to reflect on market structure issues, specifically payment for order flow and trading in dark pools. The report’s conclusion also addressed the gamification of investing at a time when platforms like Robinhood had become a popular entry point to the financial markets for first-time investors.