Shortly after Belgium, France also starts publishing “black list” of cryptocurrency websites

The “black list” includes 15 website addresses, as entities are either unaware of or are ignoring their obligations under the Sapin II law and MiFID.

Less than a month after Belgium’s Financial Services and Markets Authority (FSMA) has published its first “black list” of cryptocurrency websites that unlawfully target Belgian investors, France’s financial markets authority AMF is also ready with its version of a list naming and shaming such websites.

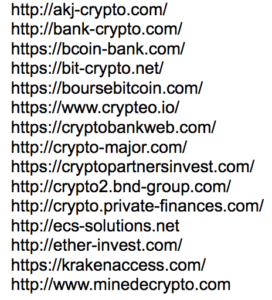

Today, the French regulator published a list that includes 15 website addresses. The entities behind these websites unlawfully propose to French residents to invest in cryptocurrencies or related assets. The AMF reminds the public that cryptocurrency businesses fall under the scope of the Sapin II law. Those that made it to the black list (which is not exhaustive) are either unaware of their obligations under the law or are ignoring these requirements.

In February this year, the AMF published its stance on the regulation of cryptocurrencies and products related to them.

Following an analysis of the legal status of cryptocurrency derivatives, the AMF has reached the conclusion that the platforms offering these products must abide by the authorisation and business conduct rules, and that these products must not be advertised via electronic means. That is, such products fall within the ambit of the famous Sapin 2 law, which prohibits the digital advertising of binary options and certain CFDs which are deemed toxic for investors.

The regulator has noted the cryptocurrency craziness that has been observed over the past few months and which has spurred several online trading platforms to offer binary options, CFDs or Forex contracts with an end-of-day maturity (rolling spot forex), where the underlying is a cryptocurrency. Such contracts allow investors to bet on a cryptocurrency’s rise or fall, without holding the underlying.

The AMF has concludeed that a cash-settled cryptocurrency contract may qualify as a derivative, irrespective of the legal qualification of a cryptocurrency. As a result, online platforms which offer cryptocurrency derivatives fall within the scope of MiFID II and must therefore comply with the authorisation, conduct of business rules, and the EMIR trade reporting obligation to a trade repository.

More importantly, these products are subject to the provisions of the Sapin II law, and notably the ban of advertisements for certain financial contracts, the regulator said.