Social trading world gets smaller, as City Index Connect goes offline

The service, which was first presented to City Index clients in the fall of 2013, is now unavailable.

The social trading segment seems to be going through some challenging times. After the recent termination of FxPro’s social trading platform SuperTrader, another social trading service has been taken offline – this time, City Index has quietly bid farewell to Connect.

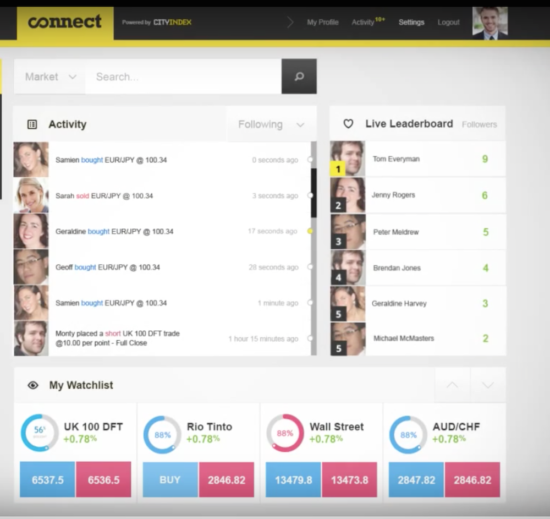

City Index Connect was initially introduced to the trading world in the fall of 2013. And although the service looked very decent and, in my personal opinion (ed.), had a potential that was not worse than that of rival services, it failed to actually take off. It offered some useful functionalities – a Live leaderboard, for instance, was displaying the top traders, whose trades one could copy or simply monitor. There was also a watchlist of popular markets, as well as the ability to create a profile and communicate with other traders.

This is how the Connect front page looked like.

Now, the website of the platform shows a sign “Service Unavailable”. My attempts to squeeze some information from the City Index customer support team ended with a blunt response saying “Connect was not on our offering”. Well, I am not happy to receive such an explanation, but I am not surprised given that months ago the ability to log in to Connect via Facebook became unavailable. Back then a customer service representative advised me to open an account with City Index and then use the service. So, I did open a demo. Now, it does not matter how one tries to use the platform. It’s off.

Of course, one can hardly blame a Forex company for letting go of a social trading platform in the current environment. Particularly in the UK, two years ago, the Financial Conduct Authority (FCA) said that social trading and copy trading is an activity that should require ‘lead traders’ – those whose trades and signals retail traders on copy trading platforms and social trading networks follow – have to qualify and be regulated as investment managers. This put an extra regulatory burden on companies providing such services.

Also, in the case of City Index, it got a new owner – GAIN Capital, back in 2014. It is possible that, as the transition of City Index’ services and assets to the new owner progressed, City Index Connect failed to make it to the priority list.